Taxware Bank Enrollment Instructions for 2024 Tax Year

Bank enrollment for EPS, Refund Advantage, Republic Bank, and TPG/Santa Barbara banks will be done within Taxware’s 2023 Wintax Program.

Check for Updates: You must have the latest version of Wintax.

Wintax: The bank enrollment application must be completed in our Wintax software, if you do not have the Wintax program installed, it is available to download from our website. If you need help installing the program, call us at 800-877-1065 and one of our technicians will help you through the process.

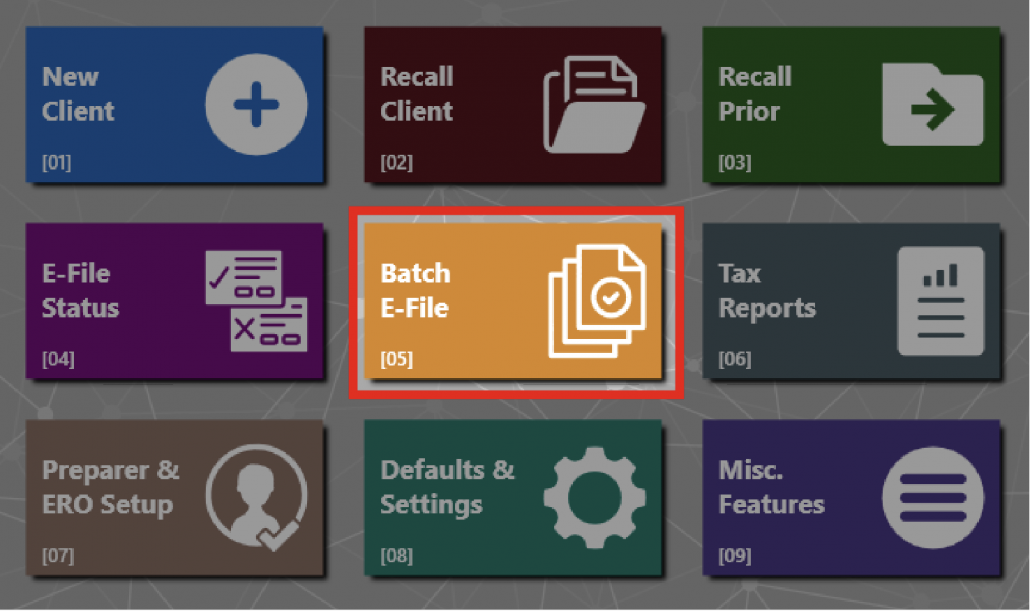

Choose “Batch E-File” [05] from the main menu.

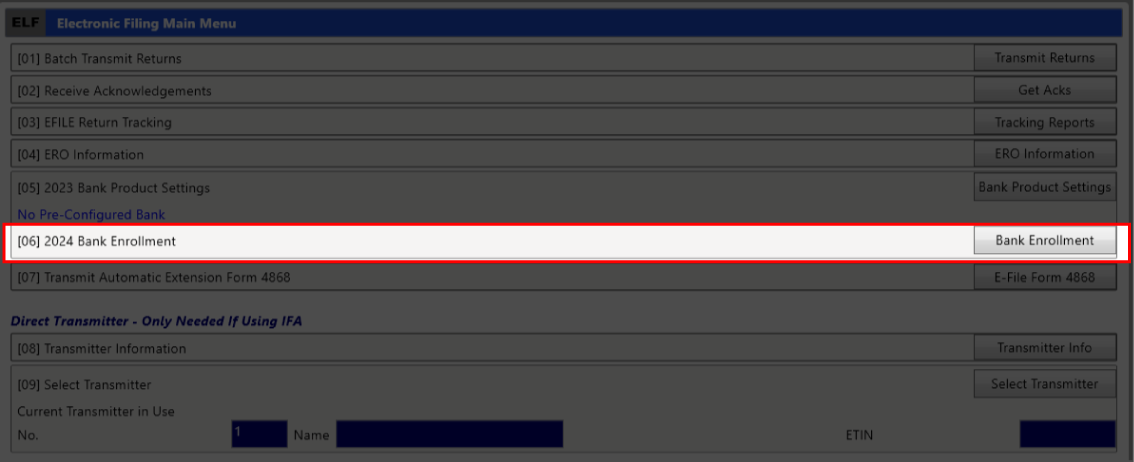

Now choose option [06] 2024 Bank Enrollment

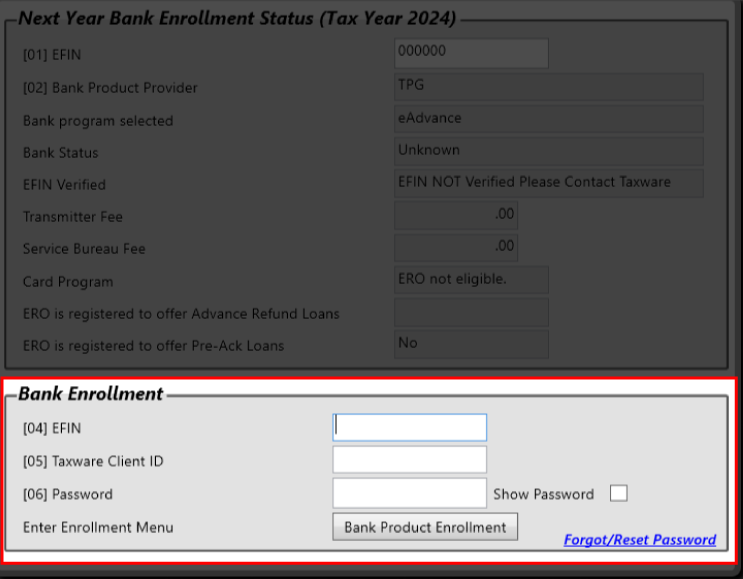

Current Bank Settings Menu:

In the Bank Enrollment section you will enter the EFIN, Taxware Client ID, and the password you used last year.

If this is your first year enrolling; enter in your EFIN, Taxware Client ID, and a password that you will remember. A new enrollment record will be created if your EFIN is not in our system.

If you are renewing your enrollment, the program will carry your prior year data forward. If you are with Refund Advantage there is quite a bit of additional information. Please take the time to review all items.

If you will be enrolling with multiple EFINs, you will do this process for each EFIN.

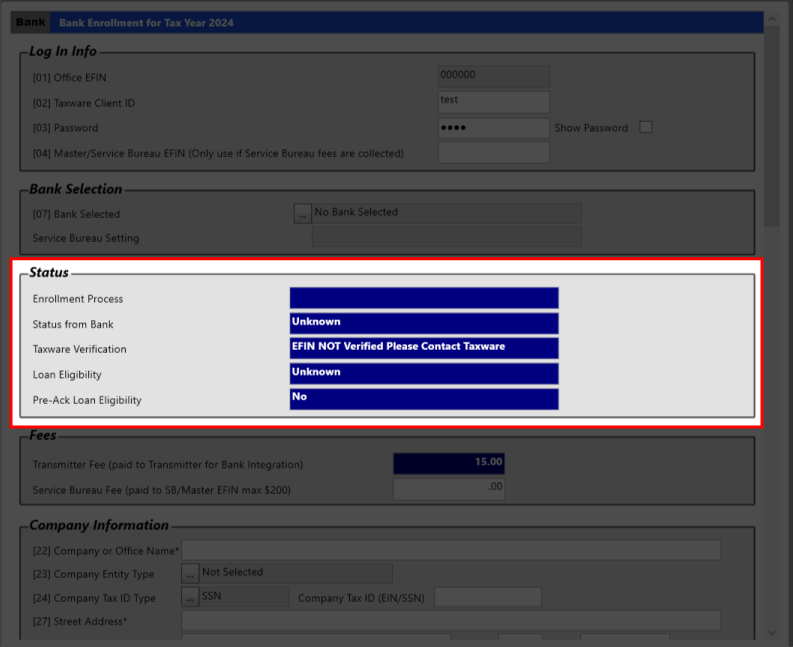

If we do not have your EFIN in our records, your EFIN will need to be verified before being able to process bank products. If you see “EFIN not verified”, please contact Taxware to get your EFIN verified.

Click on “Bank Product Enrollment” button.

The Bank Enrollment Menu will now display. Please complete all information requested.

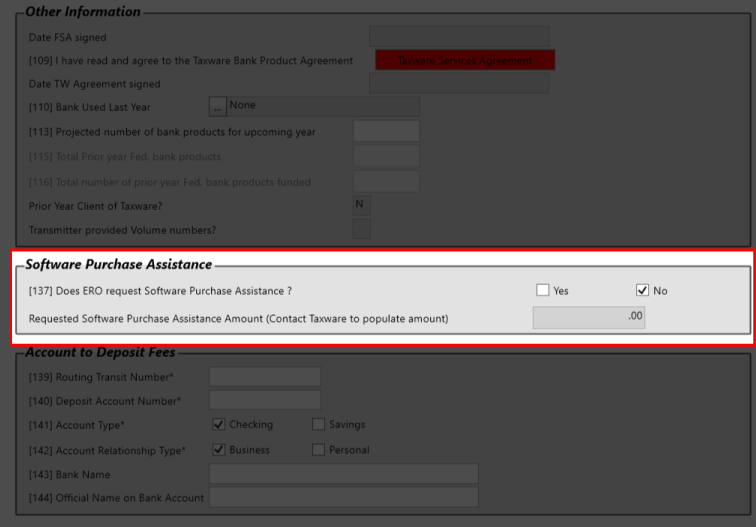

*If you are interested in the Software Purchase Assistance (SPA) program:

We have made arrangements with the banks of offering the SPA (Software Purchase Assistance) program. The SPA program will allow you to request a loan for the purchase price of the software. The loan will be paid back as you complete bank products. The loan repayments will be taken from your tax preparation fees until the loan is satisfied. Each bank has different requirements. If you are interested in requesting SPA during the enrollment process, please contact Taxware. The amount of the SPA on the enrollment screen will need to be populated by Taxware.

If you are not interested the SPA program leave the box checked “No”.

When complete click on OK at the bottom of the screen. If there are any required items missing or detected problems, these items will show in red. All red items must be corrected before the application will be submitted to the bank.

When you click OK and there are no errors detected, your bank enrollment will be submitted to the bank.

You may return to this application to view your enrollment process and status responses from the bank.