Economic Impact Payment for People That Are NOT Required to File a Tax Return and Balance Due EFW

Information continues to be released by the IRS and other agencies regarding Economic Impact Payments (EIP). We encourage you to check IRS.GOV for the latest information.

https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

The question was raised “How do taxpayers that are not required to file a tax return notify the IRS who they are and what their direct deposit information is?” Taxware was involved in a conference call with the IRS and the following is a step by step guide on how to enter the information the IRS needs for these clients.

Before we get into those steps, we have two notes.

- If you have a client that is NRF and have 1099-SSA or RRP you do NOT need to do these steps. The IRS can get what they need from the SSA and/or Railroad Retirement systems.

- If you have or will file a return that is NRF but has withholdings, and are filing to receive a refund of those withholdings, then you do NOT need to do the following steps and the tax return should be filled out and filed in a normal tax preparation fashion.

EIP Filing

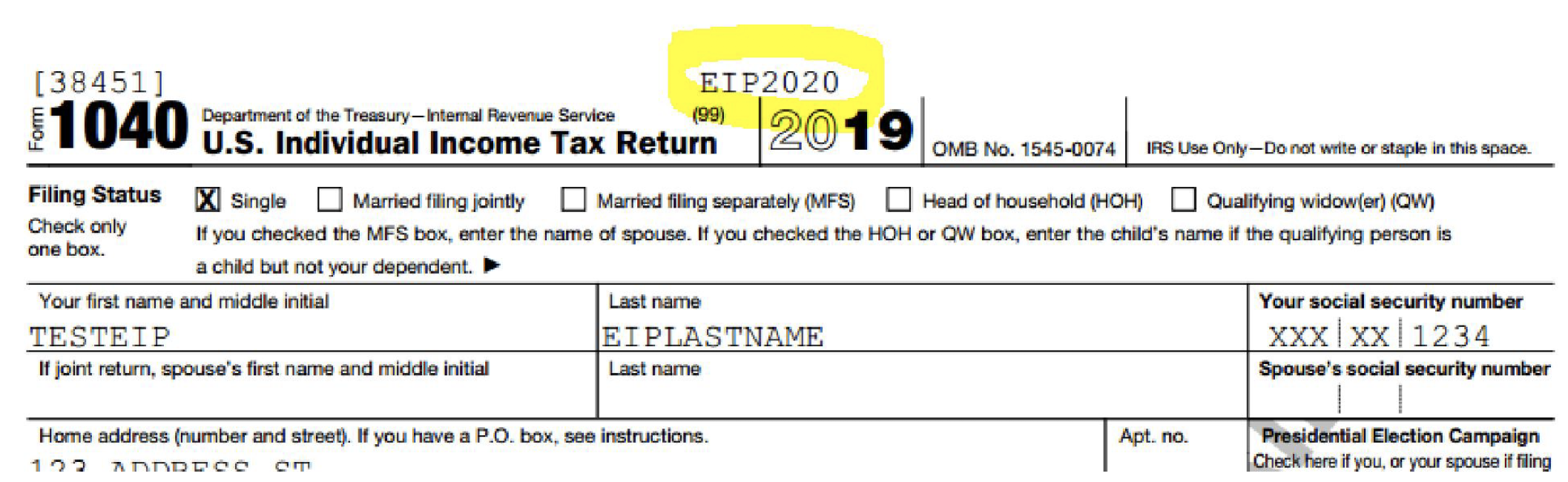

Either start a new tax return or recall an applicable tax return from the prior. Fill in the basic information for the taxpayer, spouse, and dependents like you would for normal tax preparation. The only difference is the marital status needs to be either “Single” or “Married Filing Joint”.

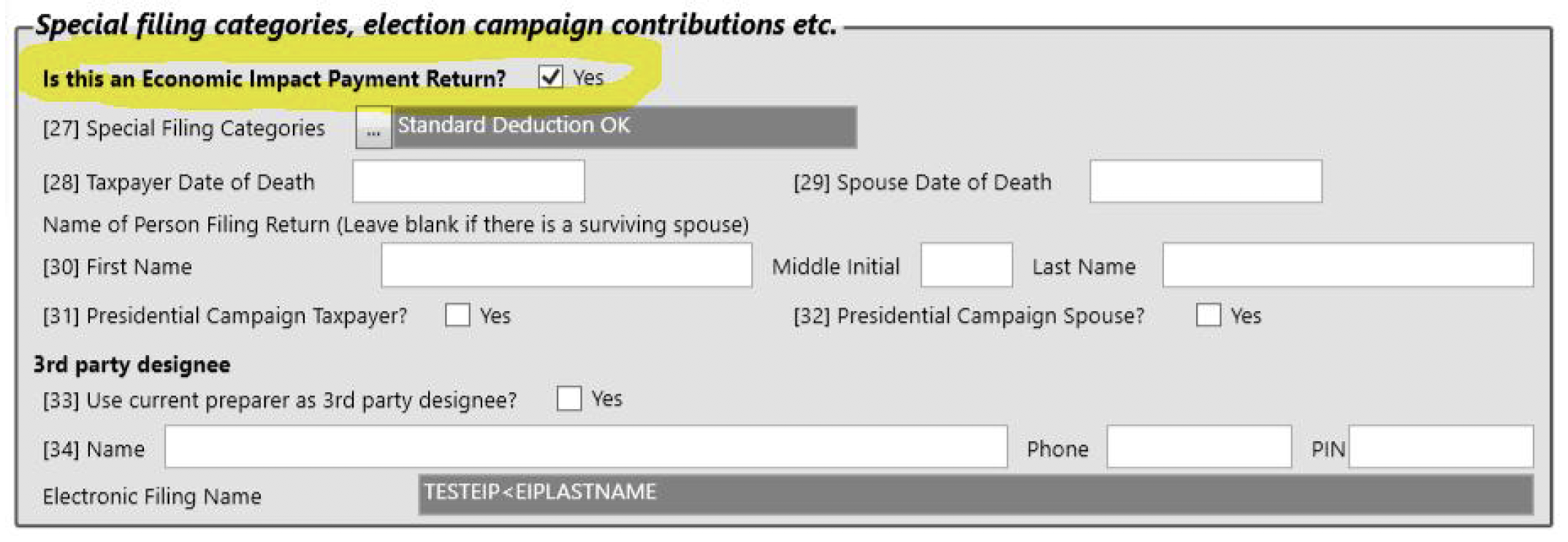

In the basic information page scroll down to the “Special Filing Categories” section. Check the box that says “Is this an Economic Impact Payment Return?”

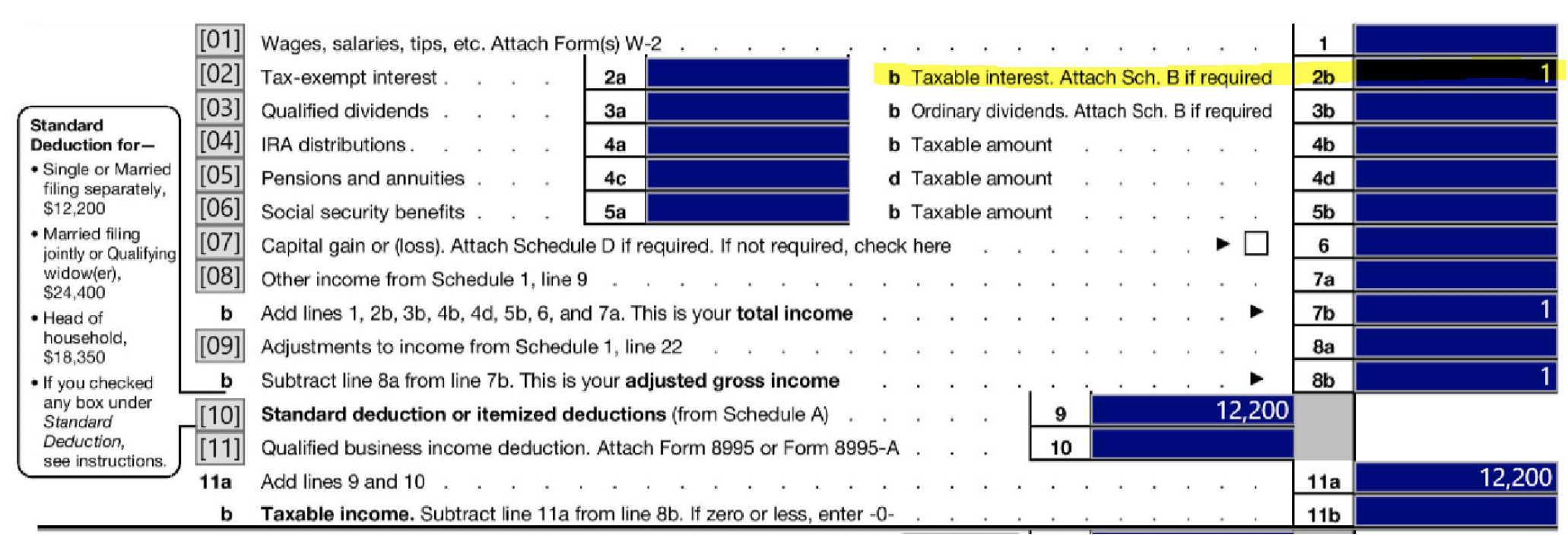

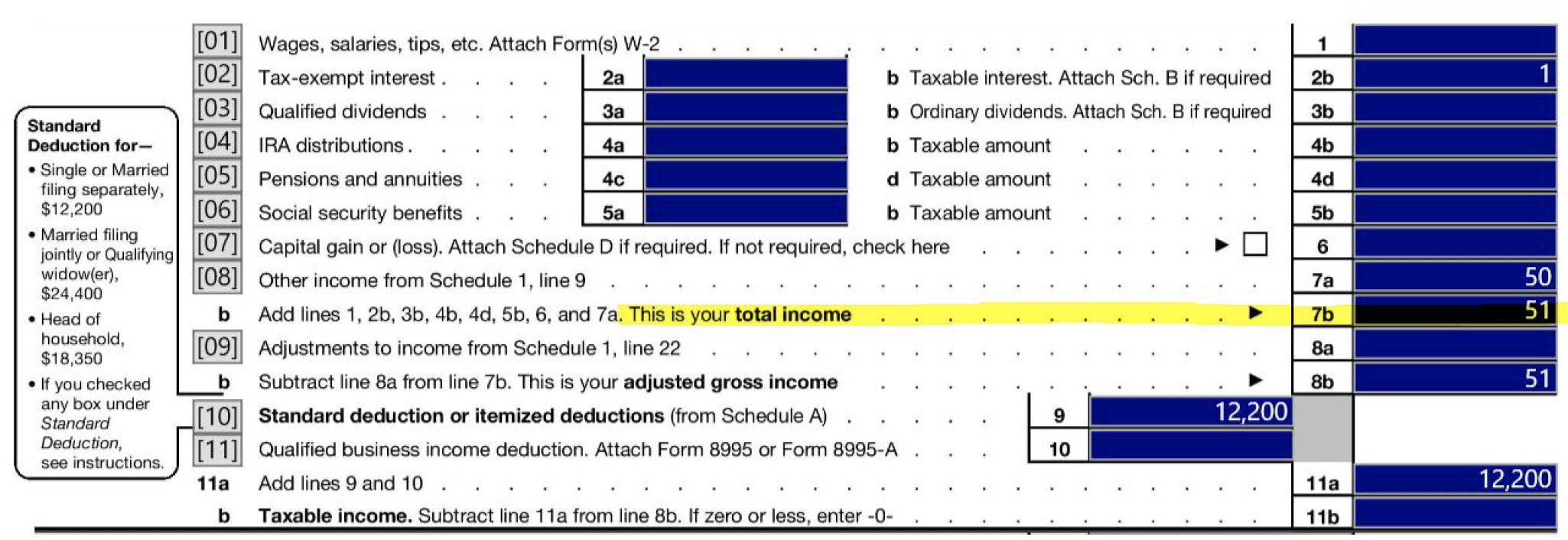

When you are finished with the basic information page click OK or type 99 to take you to the Line Input, or Forms and Schedules page. You will see that the program has populated $1 in the taxable interest field. This is by design per the IRS specifications to load 1 dollar of total income and 1 dollar of AGI. If this tax return is being filed purely for EIP information, this IS CORRECT. Please do NOT enter any further information or dollar amounts. If you have additional amounts you need to report to the IRS then a normal tax return should be filed without the EIP checkbox selected.

With this check box selected, it will add a flag into the electronic record that lets the IRS know it is specifically an EIP return.

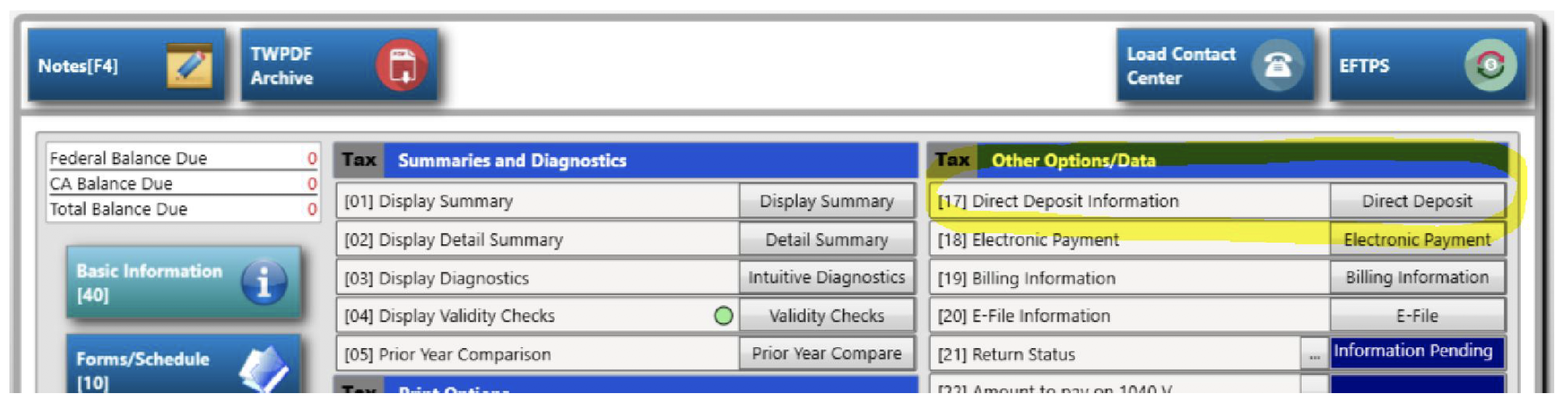

Leave the “Line Input” or “Forms & Schedules” page and go to the tax return “Summary” page. Select the [17] “Direct Deposit” button if EIP direct deposit is wanted.

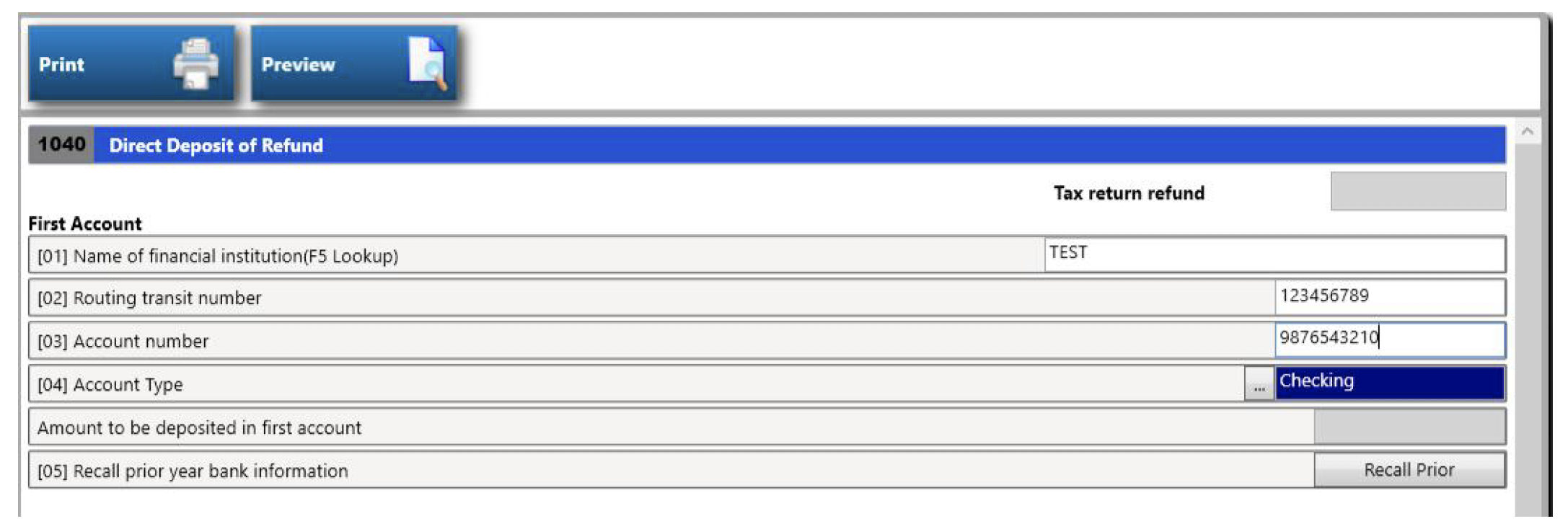

Fill in the applicable direct deposit information. Obviously, there is no tax refund but this information will be passed to the IRS so they have the banking information to make the EIP deposit.

After you have filled in the direct deposit information, go back to the summary page and select option [20] “E-File Information”. Print the 8879 like a normal tax return. You can now transmit this EIP tax return and the client will be included when the IRS disperses EIP funds.

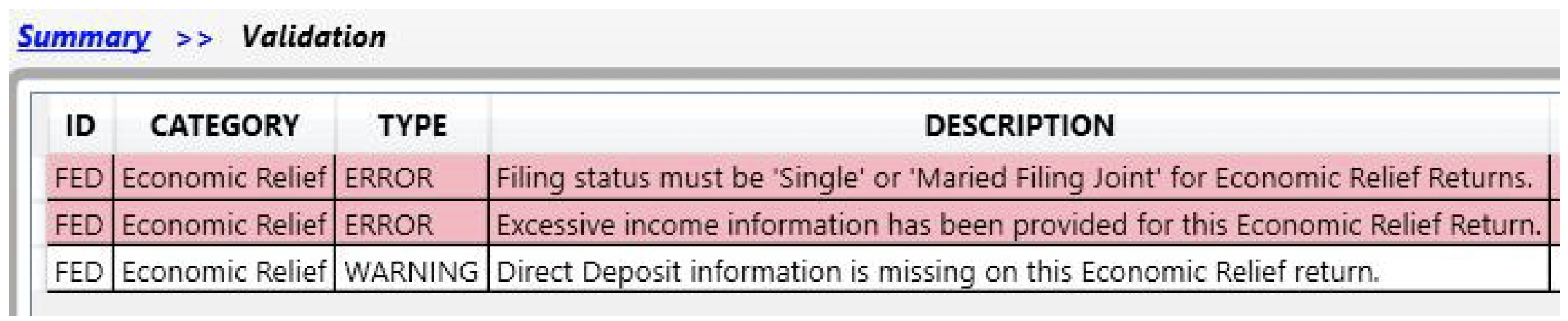

Prior to electronic filing its always a good idea to go into the validation section of the program. We have added a few additional validations specific to EIP tax returns.

- If you have checked the EIP checkbox in the basic information, but have included additional money items, the program will flag that. Either take out the additional money items or uncheck the EIP checkbox and file a normal tax return.

- If you have selected a marital status that is NOT “Single” or “MFJ”. For these EIP returns the IRS wants only those two filing status selections.

- We are assuming that one of the main reasons you are filing the EIP return is to get the IRS your clients banking information. We produce a “Warning” if EIP is selected but NO direct deposit banking information was entered. Note that this warning will not stop the return from being filed like validation “Errors”. If the EIP return is sent without banking information the IRS will mail a check.

Example of Excessive income:

If your client doesn’t want to have their information sent electronically, they can paper file and mail it to the IRS. All of the above steps would be the same except instead of E-Filing the return you would print it and mail it in. At the top of the EIP 1040 the words “EIP2020” will print. This will notify the IRS of the special EIP processing.

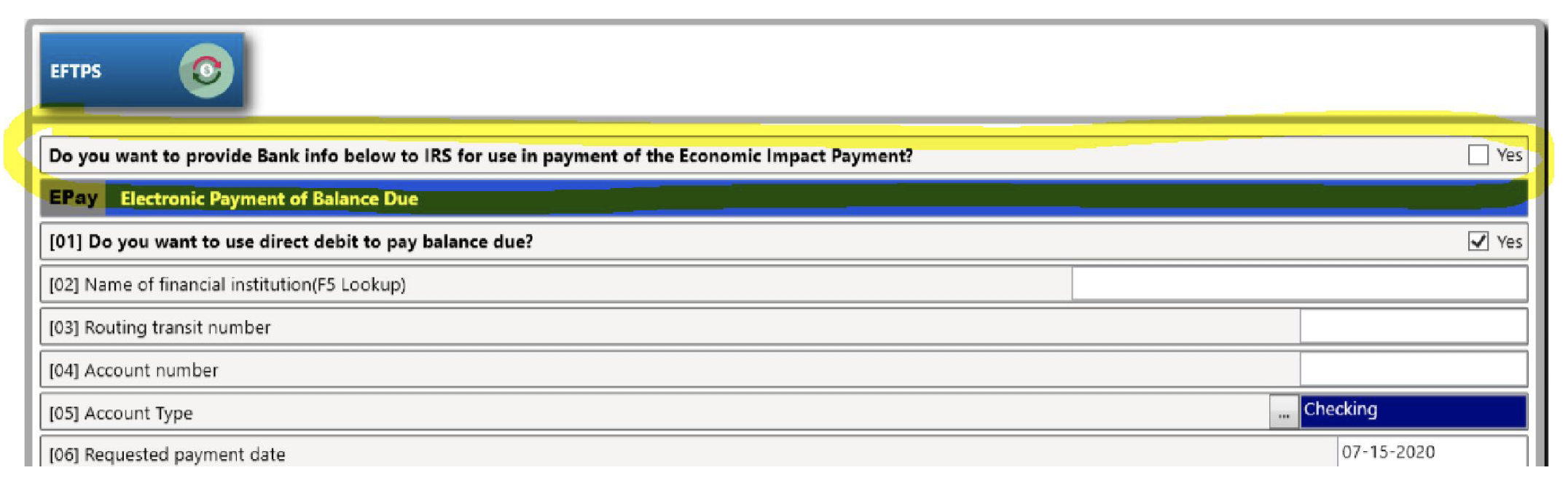

Balance Due Tax Returns with Direct Debit

The program will give you an option to use your direct debit banking information as your EIP direct deposit banking information. In the electronic payment information located from the summary page, select the first checked box titled “Do you want to provide Bank info below to IRS for use in payment of the Economic Impact Payment?”. If this is selected/checked the program will include the provided direct debit information in both the direct debit and direct deposit sections of the electronically filed tax return.

The above applies if your client is wanting an electronic funds withdrawal and is providing banking information to facilitate the direct debit. If your client would like to mail the balance due payment to the IRS using Form 1040-V, but would like to have their EIP payment direct deposited, go to the Direct Deposit page and enter the banking information like you would for a tax return with a federal refund.

This will only apply to tax returns this year for the narrow period of time in which you are filing tax returns before the IRS disburses the EIP payments. If the IRS cannot locate valid direct deposit bank information, they will process EIP payments via paper check. If they have already processed a check then the direct deposit information will not be used or reissued.

The IRS is working on providing a web portal for tax payers to enter direct deposit information but we do not have details or a link to that service at this time.