What has changed for IRS PTIN Renewals in 2025?

Important PTIN Renewal Updates from the IRS

It’s time once again for tax professionals to renew their Preparer Tax Identification Numbers (PTINs). This year, the IRS has introduced a major change to the PTIN sign-in process for those with a Social Security number (SSN). Tax preparers will now need to sign in using ID.me, a secure identity verification service already used by other federal and state agencies. The traditional Username and Password login method will soon be discontinued, so all preparers with an SSN must set up an ID.me account to access the Tax Professional PTIN System. Preparers without an SSN will continue using their existing login process.

If you already have an ID.me account through another government agency, you can sign in using your existing credentials — no need to reverify your identity. New users, however, must create an ID.me account before renewing or applying for a PTIN. To register, you’ll need a government-issued photo ID, an email address, and a camera-enabled computer or mobile device. ID.me provides multiple verification options and 24/7 customer support to help ensure a smooth setup process. Once established, your ID.me credentials will also grant access to other IRS online tools such as the Tax Pro Account, Business Tax Account, and Individual Online Account.

With the current government shutdown, it’s important to note that the IRS will have very limited live assistance available for those encountering issues with the PTIN renewal process. The PTIN Information Line and other help desks may experience long wait times or temporary closures. To avoid delays, we strongly recommend reviewing all renewal instructions in advance and carefully following the detailed guidance provided by the IRS. The following pages are particularly helpful in walking you through the process: irs.gov/ptin for general PTIN information, and irs.gov/registerhelp for ID.me setup and troubleshooting support, as well as this FAQ for PTIN renewal process.

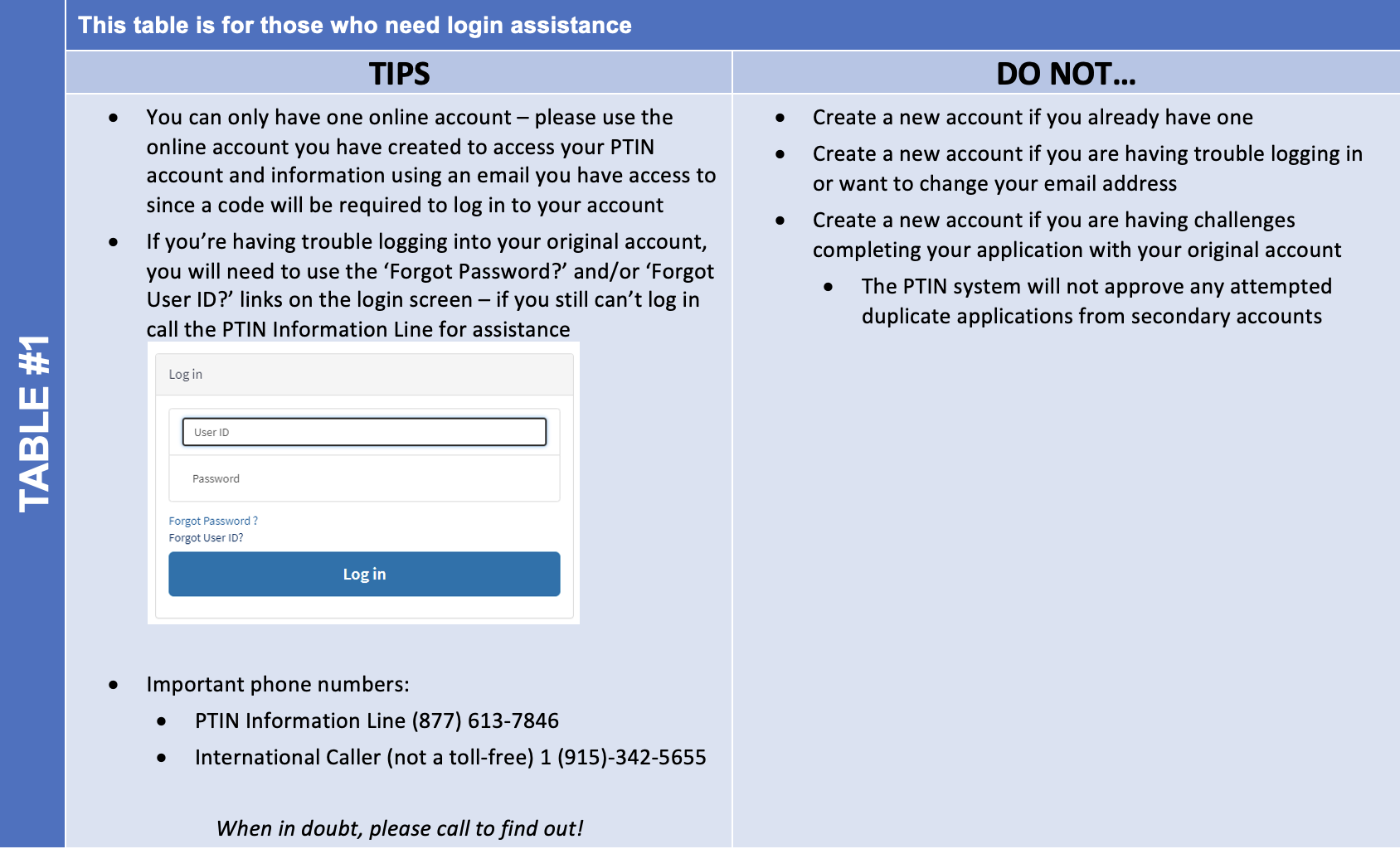

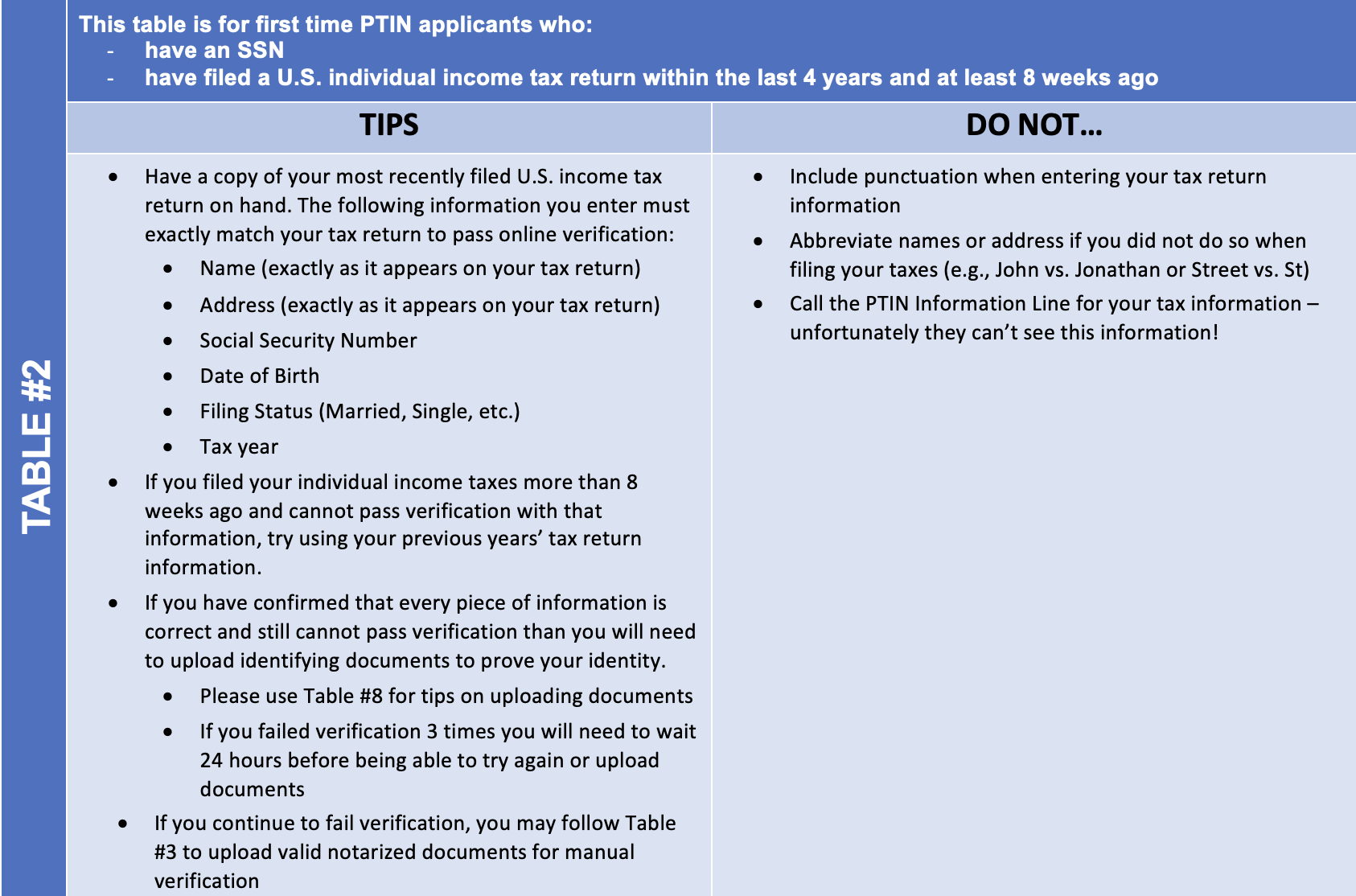

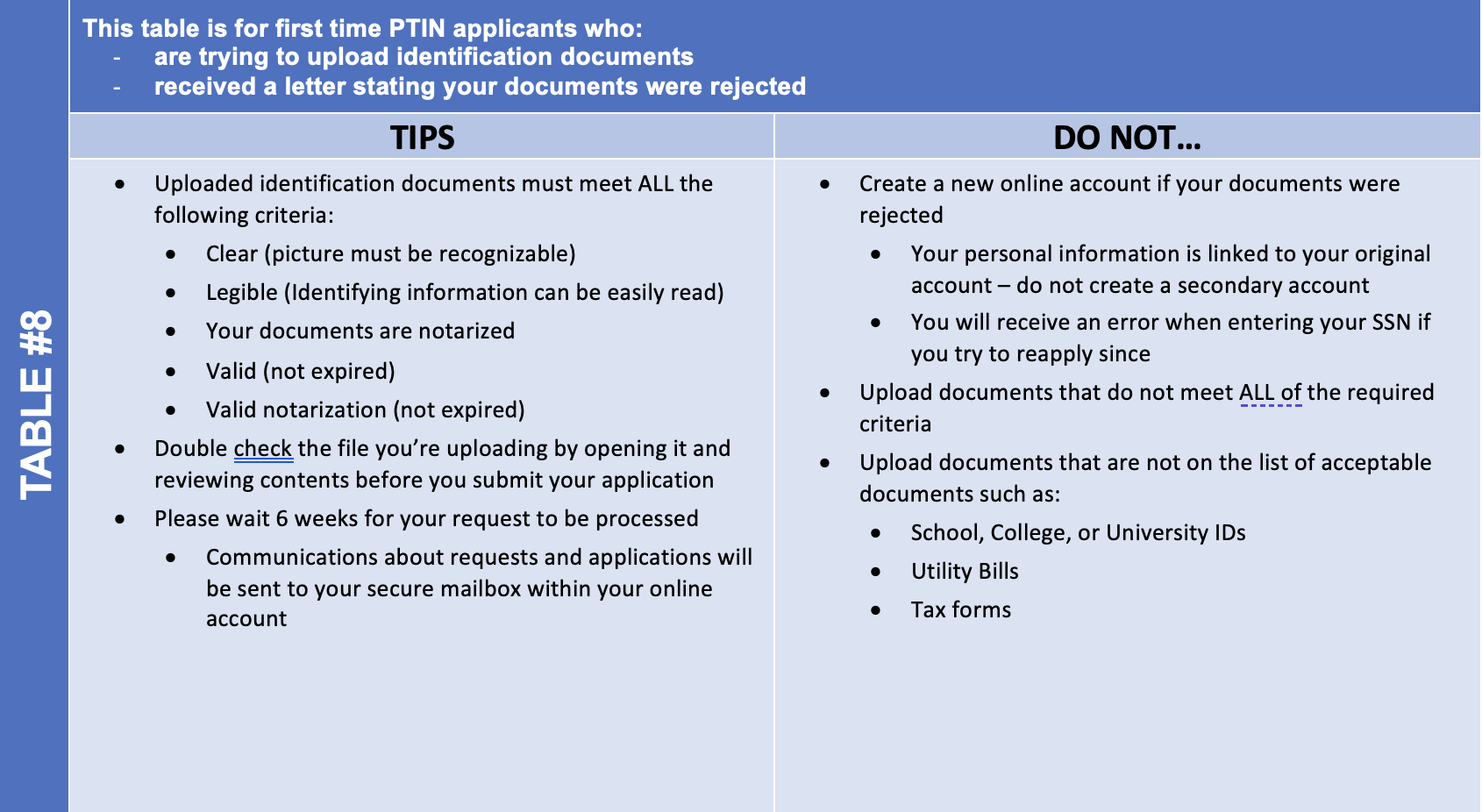

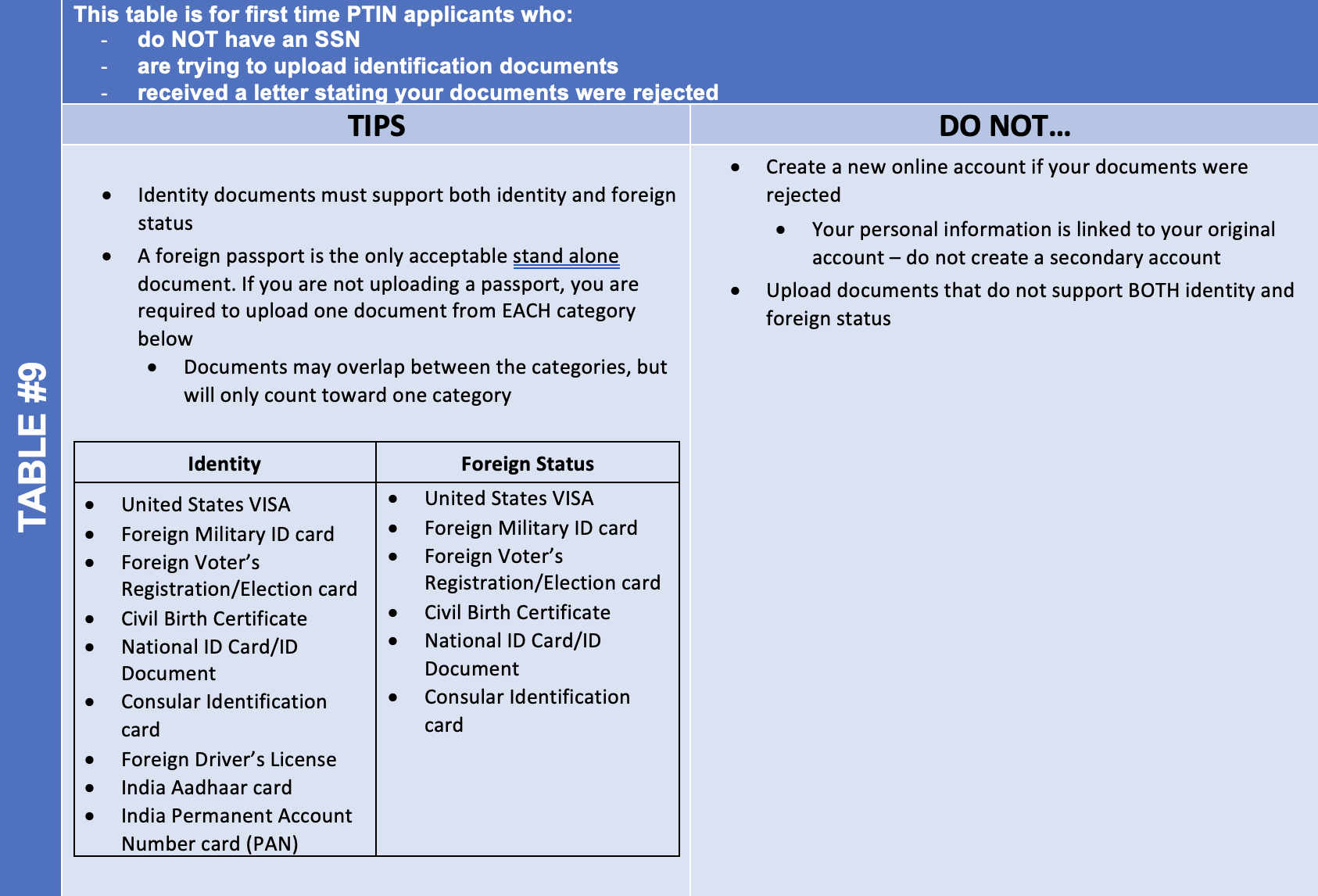

To help prevent common errors, remember you should only have one online PTIN account — do not create duplicates if you experience login issues. Use the “Forgot Password” or “Forgot User ID” links, or call the PTIN Information Line at (877) 613-7846 if assistance is available. When renewing, ensure your name, address, and other details exactly match your most recent tax return. If your PTIN has been expired for three or more years, you’ll need to reapply as a new user and verify your identity again. Double-check that any documents you upload are clear, valid, and properly notarized to avoid delays.

PTIN Helpful Tips

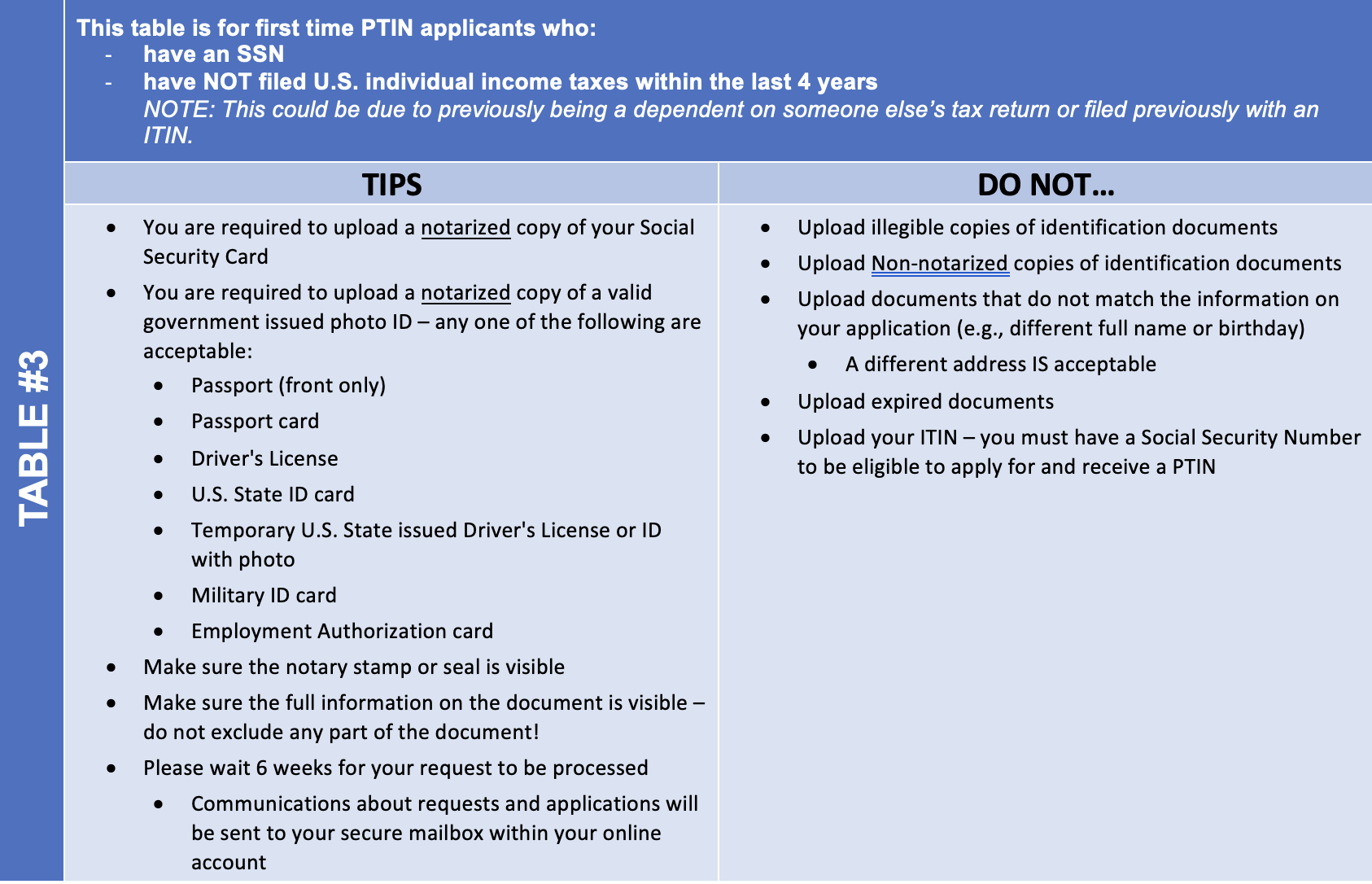

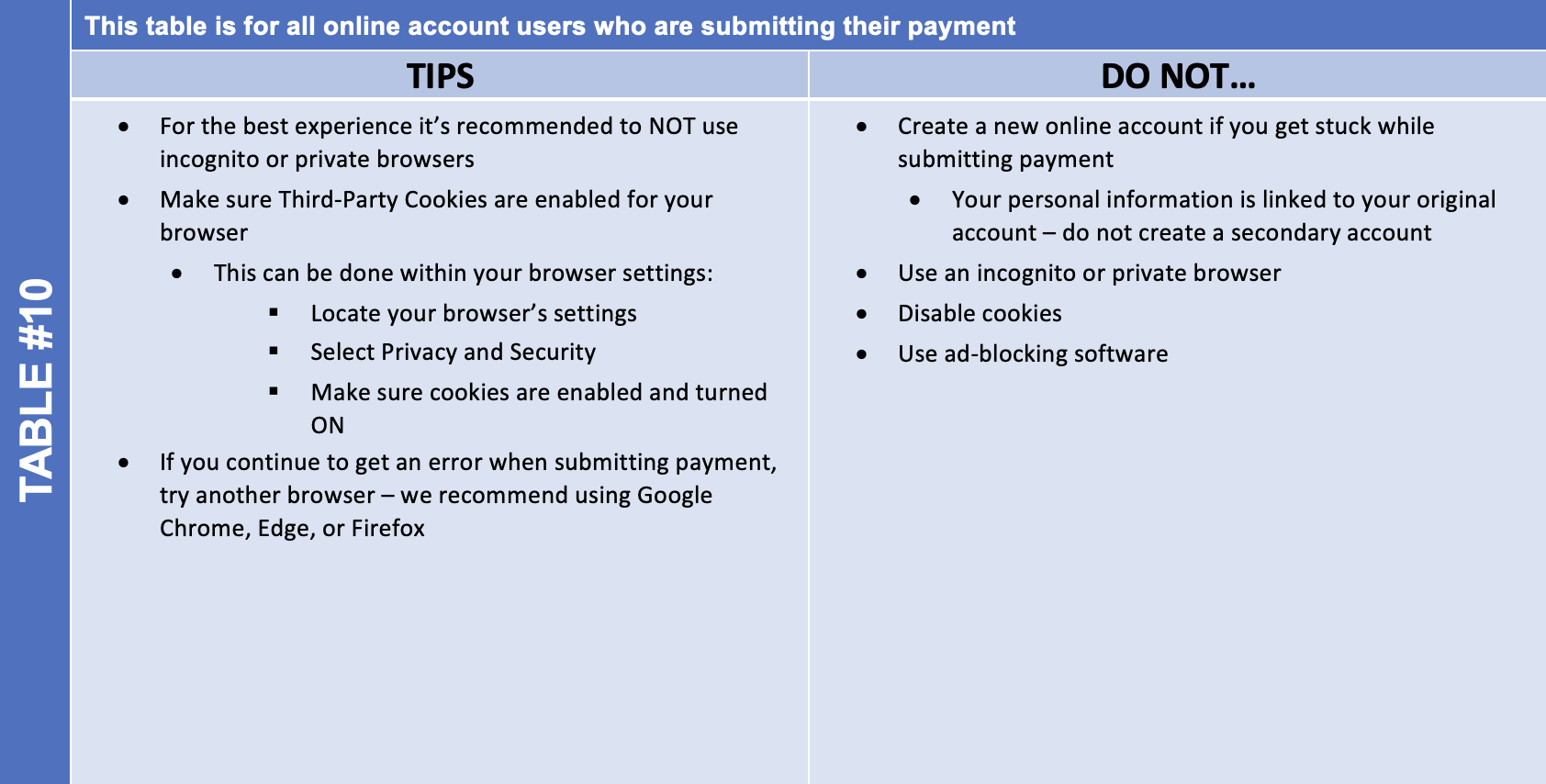

The following tables should help with common issues for those applying or renewing their PTINs. Please refer to the table that best describes what kind of PTIN transaction you are attempting.

Table of Contents

TABLE #1 Having trouble logging in

TABLE #2 Initial Application with SSN

TABLE #3 Initial Application with SSN (No recent tax return)

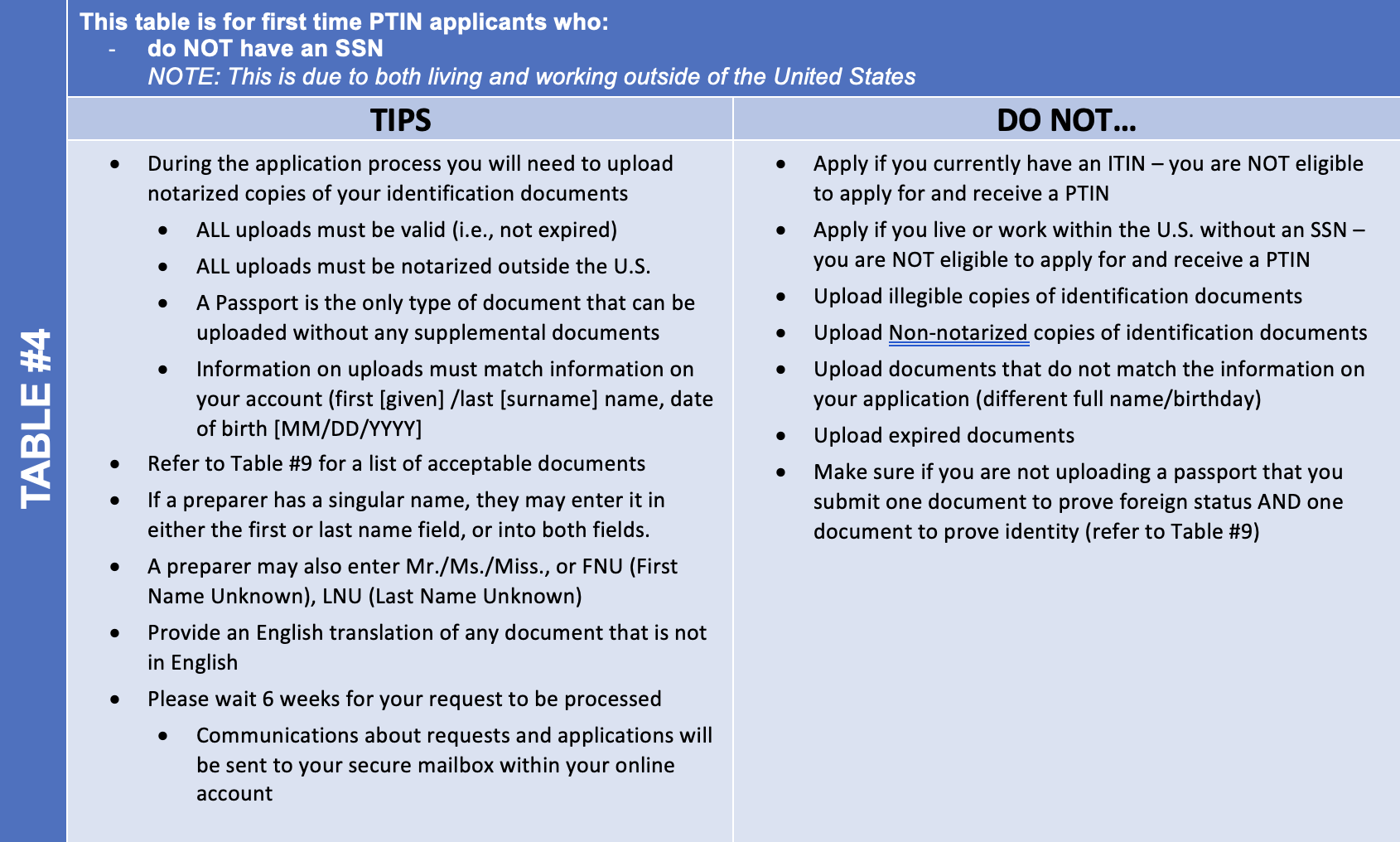

TABLE #4 Initial Application without SSN

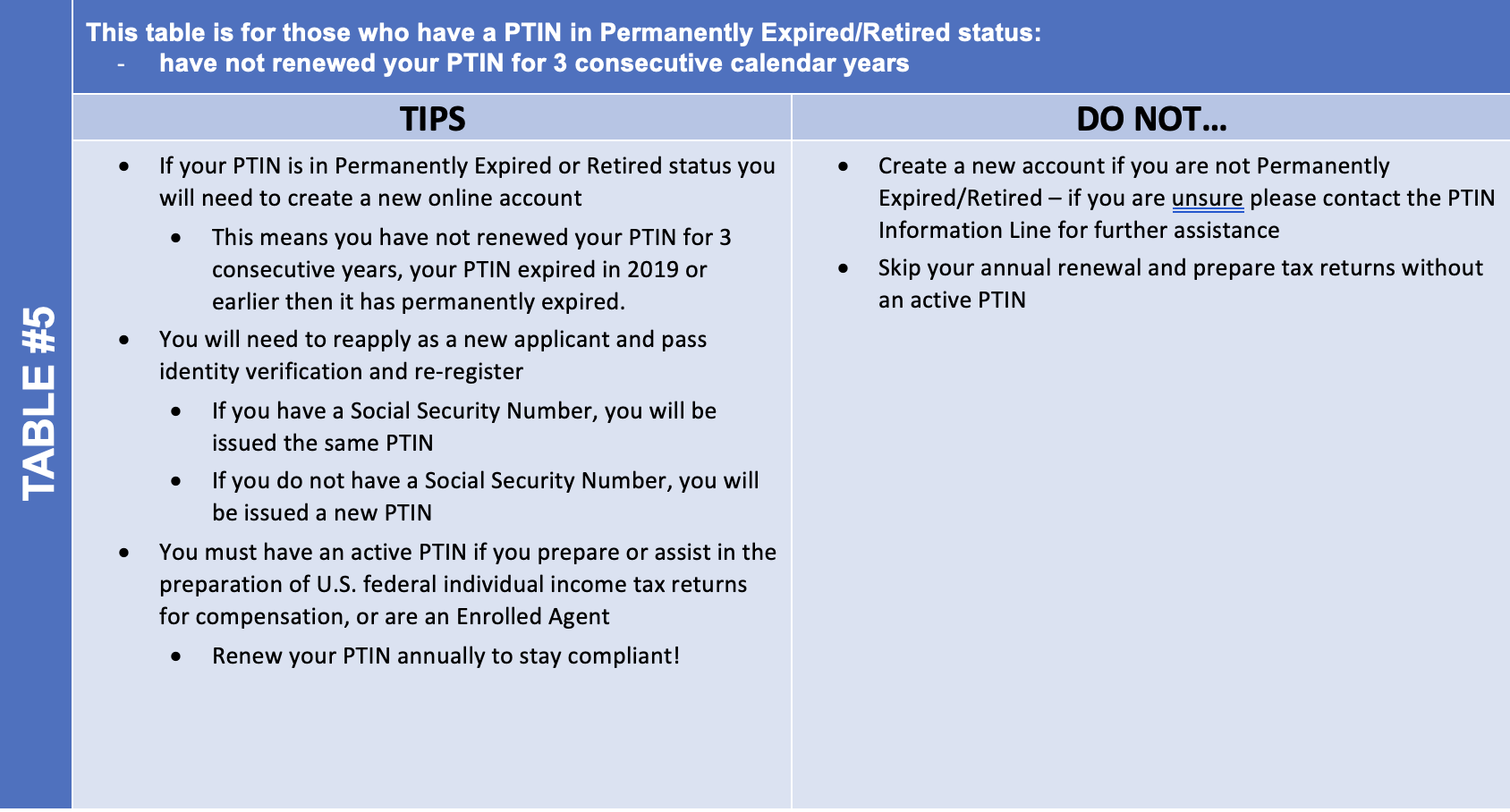

TABLE #5 Renewal Application with SSN

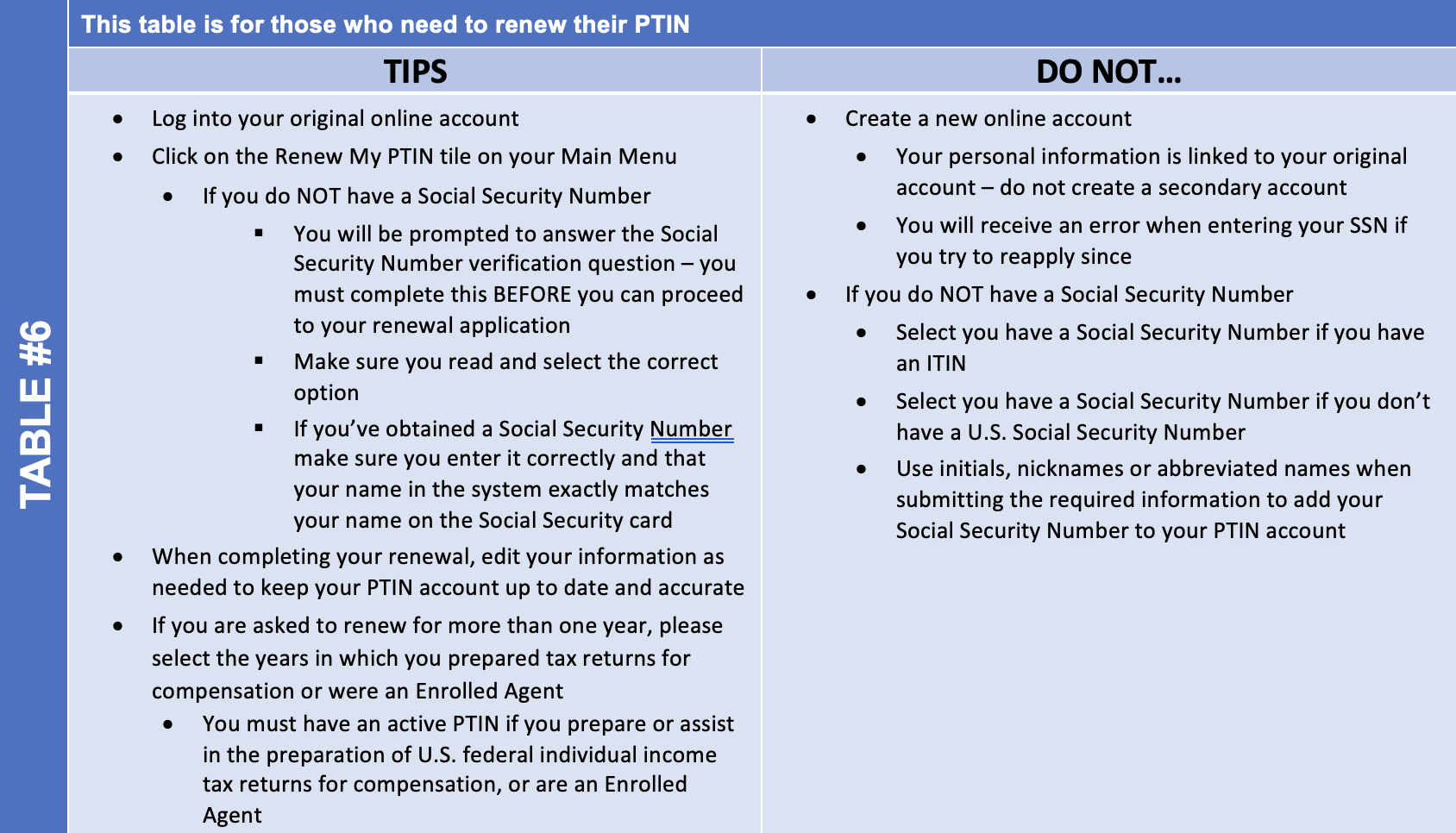

TABLE #6 Renewal Application without SSN

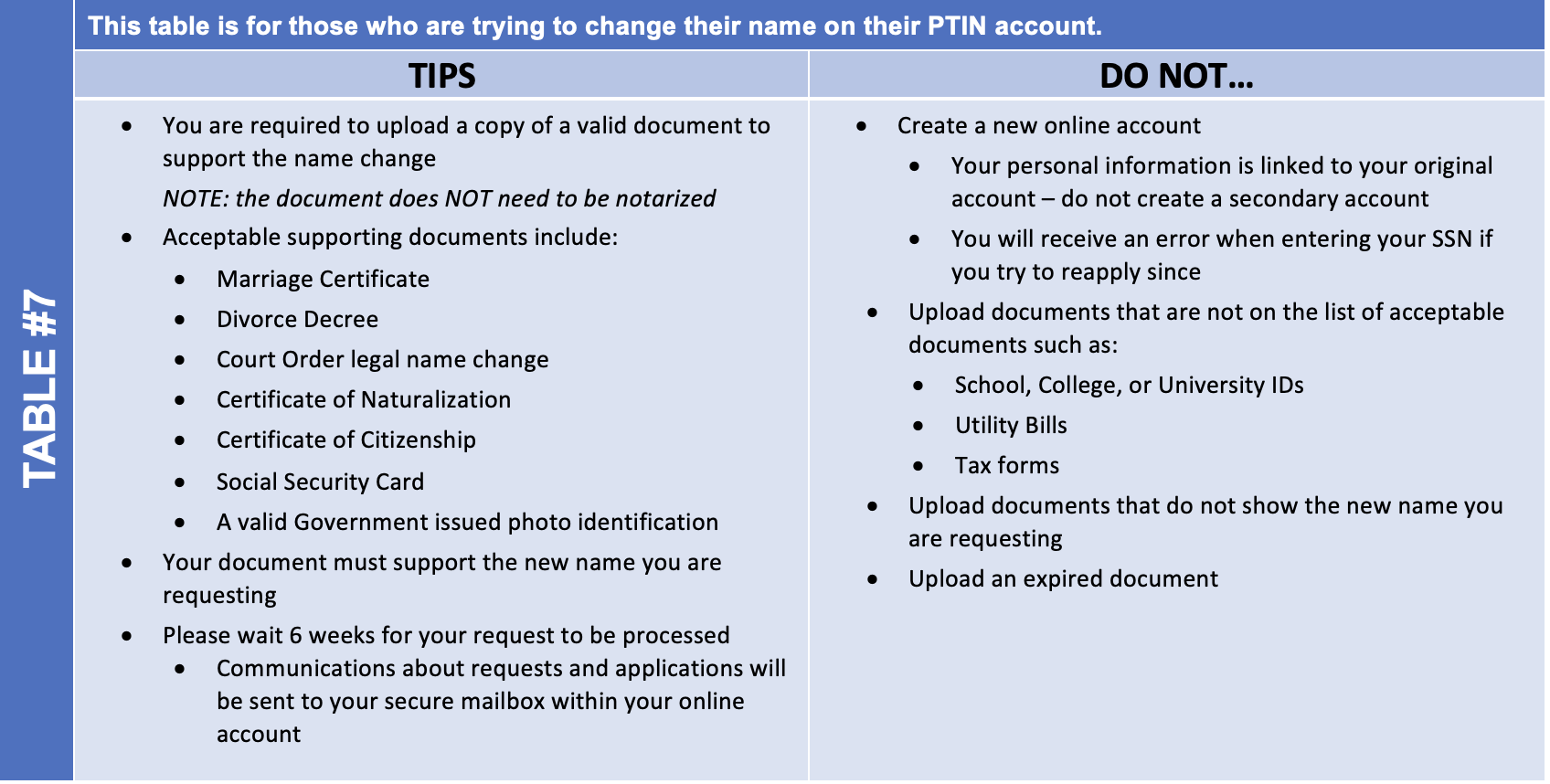

TABLE #7 Trying to change the name in your account

TABLE #8 Uploading Identification Documents

TABLE #9 Acceptable Documents for applicants without an SSN

TABLE #10 Successfully making a payment

**PTIN Helpful Hints and tables provided by IRS CERCA Presentation October 2024**