Information Regarding Child Tax Credit Advance Payments External Inbox

With the announcement of the Child Tax Credit advance payments, we felt the need to add an additional client listing report and excel export option. This is to aid you in your communication efforts with your clients and offer applicable notifications and advice.

The IRS is sending some letters to taxpayers with additional information and has set up www.irs.gov/childtaxcredit2021 that offers more details and the ability to opt out. This webpage also has tools for non-filers to enter their information.

I found this IRS Q&A section interesting:

Q H1. How do I reconcile my advance Child Tax Credit payments and my Child Tax Credit on my 2021 tax return? (added June 14, 2021)

A1. When you file your 2021 tax return during the 2022 tax filing season, you will need to compare:

- The total amount of the advance Child Tax Credit payments that you received during 2021; with

- The amount of the Child Tax Credit that you can properly claim on your 2021 tax return.

Excess Child Tax Credit Amount: If the amount of your Child Tax Credit exceeds the total amount of your advance Child Tax Credit payments, you can claim the remaining amount of your Child Tax Credit on your 2021 tax return.

Excess Advance Child Tax Credit Payment Amount: If you receive a total amount of advance Child Tax Credit payments that exceeds the amount of Child Tax Credit that you can properly claim on your 2021 tax year, you may need to repay to the IRS some or all of that excess payment.

In January 2022, the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021. Please keep this letter regarding your advance Child Tax Credit payments with your tax records. You may need to refer to this letter when you file your 2021 tax return during the 2022 tax filing season.

I think there might be the misconception by taxpayers that these advance CTC payments are just like the EIP payments. When the advance CTC payments are reconciled on a taxpayers 2021 tax return, they will reduce their CTC amount and may even produce a balance due on their tax return.

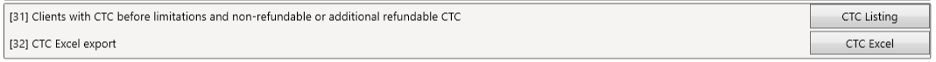

To access the report and excel file, select “Tax Reports” and scroll down to “Other Reports” options 31 and 32.

The report and excel file will filter clients that have an amount on the CTC worksheet before limitations and have a non-refundable amount or an additional refundable amount.