Updated Unemployment Compensation Exclusion

The IRS revised their unemployment exclusion worksheet today. The change basically excludes the Unemployment subtraction from MAGI calculation in the forms and worksheets listed in the IRS link listed below. We have applied these worksheet changes to the Wintax – 1040 program and they are available in the latest update.

irs.gov/forms-pubs/new-exclusion-of-up-to-10200-of-unemployment-compensation

The IRS is still working on trying to calculate these adjustments in their backend systems and not requiring or wanting amended returns due to the changes in the “American Rescue Plan”. Despite some news articles reporting that the IRS will adjust these tax returns on the backend, our conference call with the IRS this morning indicated that it was not completely decided. I think that they are leaning that direction but it is still a possibility that these returns may need to be amended.

The IRS is asking that you do NOT amend these returns at this time and to wait for further details.

We have been working on the identifying pre-American Rescue Plan adjustments and we have a two-pronged approach.

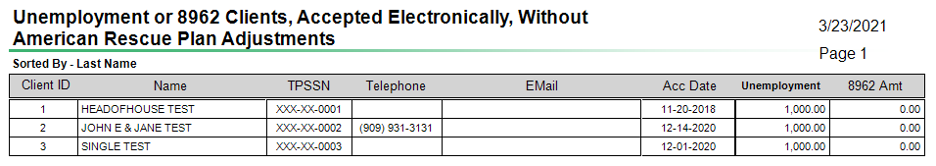

1. In “Reports” we have added a report to identify clients that you have filed returns for without the “American Rescue Plan” adjustments. It will not be able to cover clients that had the calculation added during the day that the new calculations where added. It will not be able to include clients that you have manually made the adjustment prior to the IRS releasing the worksheet. It is based on the following criteria.

- They have an accepted e-file date.

- Unemployment has a value and the new adjustment value has NOT been calculated.

- The 8962 values have been added. (future)

- Or Taxware has set an internal flag during current client recall with the above parameters.

2. We don’t know if this will be needed, but we have added a prompt with functionality that will ask if they want to auto populate the original column on Form 1040X, and make a backup of the original return prior to any calculation adjustments.

Premium Tax Credit – Please stay tuned.

During our conference call the IRS did not have any additional information, or a firm time line on when they would release information, regarding the premium tax credit. When asked specifically about it they gave a general timeline of the end of this week or next week.

Effective for 2020 only, any advance payment that exceeds the Premium Tax Credit allowed is disregarded and does not increase tax liability on the return. This suspension applies to all taxpayers regardless of income level as a percentage of the federal poverty level.

The IRS’s first priority was the Unemployment Exclusion change and we expect more information on the APTC in the near future. For now, if you have clients that this would apply to, we would advise holding these returns until further information is available.