IRS Business Rule F8962-070

IRS Business Rule F8962-070

IRS Description

“The e-File database indicates that Form 8962 or a binary attachment with description containing “ACA Explanation” must be present in the return.”

This E-File reject is triggered if the IRS has information that indicates that either you, your spouse or one of your dependents has received health insurance from the Market Place.

How to Fix:

1. File form 8962

First check to see if the taxpayer has the form 1095-A. If so, use the information on form 1095-A and complete the form 8962. This will likely require a fair amount of digging. The tax client will need to double or triple check that they did not receive insurance through the Market Place. If at all possible, get the 1095A and file the 8962. This is by far the best solution to the error to avoid future letters from the IRS.

-or-

2. Attach PDF with ACA explanation

If you are sure that the 8962 is not required, then you can attach a PDF with the explanation of why the 8962 is not needed.

There is no complete list of reasons why the 8962 is not needed but, here are a few possible examples given by the IRS as to why the 8962 may not be needed:

- The Taxpayer or the spouse is covered by the Market Place insurance but it is not their policy. They are covered under their parent’s policy.

- Two parents filing separate tax returns and the dependent is covered by Market Place insurance under the father but is being claimed as a dependent on the mother’s tax return. Or vise versa.

- Insurance was started at the end of they year, but has been cancelled, but the cancellation has not had time to update the IRS records of the cancellation.

The PDF will get the tax return accepted but unless it is a valid reason, your client will probably get a notice from the IRS wanting more information and any refunds will likely be delayed.

Notice: Please be aware that this ACA explanation can get the tax return accepted but it may not resolve the issue that the IRS is expecting to see the 8962 and it still may delay the refund. If the explanation that you give them does not satisfy the IRS, then your client will likely receive a notice and will have to deal with it later.

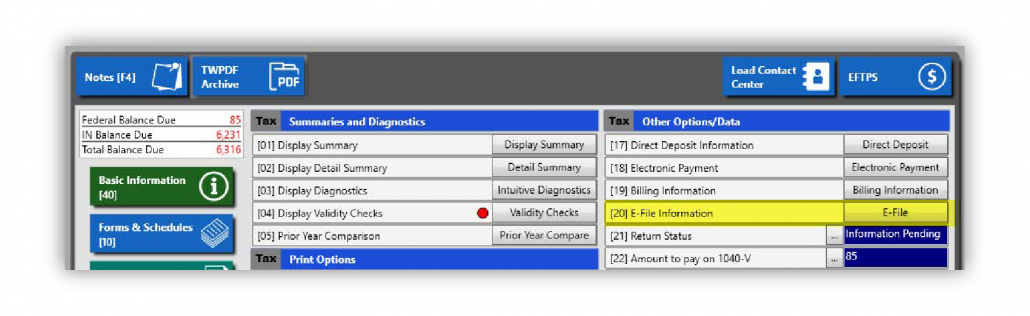

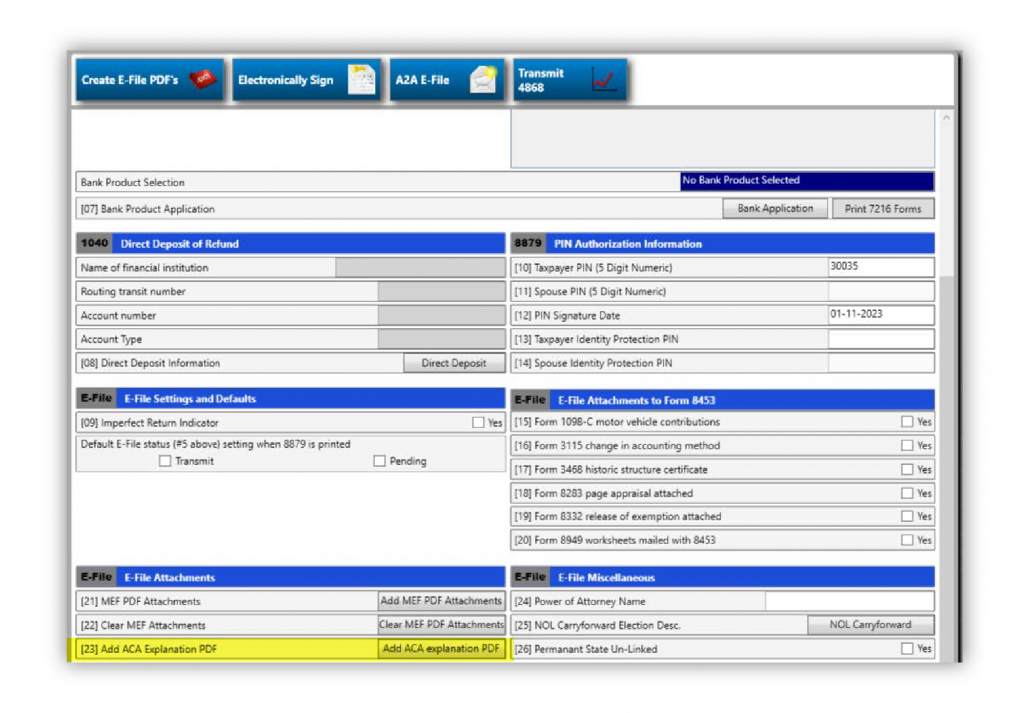

To create attach this ACA explanation, from the Summary Menu, go to the “E-File Info” screen.

Then select option # 23 at bottom of the E-file Info screen.