California Middle Class Tax Refund

California’s MCTR has raised a lot of questions in the tax industry. At this point I don’t think anyone has a definitive answer and honestly, I see valid arguments on both sides of the ultimate question of whether it is taxable.

One take away I did have from this topic is that this is another example of how relevant you are as a tax professional verses DIY software being the tax preparer. Having you as a resource to talk through the pros and cons with the taxpayer, in a way they can understand, so they can be part of the overall decision. In my opinion, this is something that can’t be replaced.

Is the California Middle Class Tax Refund or MCTR taxable? Why did CA issue 1099-Misc to recipients? Why are some leading tax research companies issuing publications stating that is taxable and others issuing statements that it is not taxable? Why has the IRS not weighed in with any clarification? My favorite, why have most media outlets and the CA FTB used the line “Consult your tax professional”?

Obviously regarding this issue, we all probably have more questions than answers. Let’s start with what we do know. We do know that it is NOT taxable to California. “The MCTR payment is not taxable for California state income tax purposes. You do not need to claim the payment as income on your California income tax return. You should seek guidance from the IRS regarding federal taxability.

The MCTR payments may be considered federal income. As such, 1099-MISC for MCTR payments of $600 or more will be issued. You should consult the IRS or your tax professional regarding the federal tax treatment of these payments.”

What that means is that if you input and claim the MCTR as income on the Federal tax return it should be backed out as a subtraction on CA Schedule CA.

Now let’s talk about what we don’t know. As I have researched this issue it seems there are basically two main arguments. The first is that it’s taxable. Leading authorities, like Spidell, present that this is not a tax refund but does not qualify for the General Welfare Benefit rule as it was not directly linked to a disaster event like the previous economic stimulus payments which are directly associated with COVID-19 provisions. The MCTR was given to help with high inflationary items such as increased gas and grocery costs that could be indirectly caused by COVID-19 but not directly. The other supporting argument is California’s statements and actions in reference and contrast to the earlier “Golden State Stimulus Payments”. The state did not issue a 1099 for those payments because it believed they qualified for a federal tax exemption under Section 139 of the Internal Revenue Code for disaster relief funds or the general welfare exemption under federal law. Whereas the state did issue 1099’s for the MCTR. For more information I would direct you to read AB192.

The next argument is that it is not taxable and does qualify as exempt and meet the main requirements under the “General Welfare Exclusion”. (1) be made from a governmental fund, (2) be for the promotion of general welfare (i.e., generally based on individual or family needs such as housing, education, and basic sustenance expenses), and (3) not represent compensation for services. See Rev. Proc. 2014-35.

Which argument is correct I will leave to you and your tax clients to discuss and weigh the potential pros and cons.

Regardless, it would be nice to have the IRS weigh in with some guidance on this issue. It is a little frustrating and I agree with the comments that others have made that CA is “punting now that it’s tax time” and didn’t work with the IRS a head of time to provide better guidance. Depending on if or how the IRS weighs in I think there will be some interesting Tax Court cases in the future.

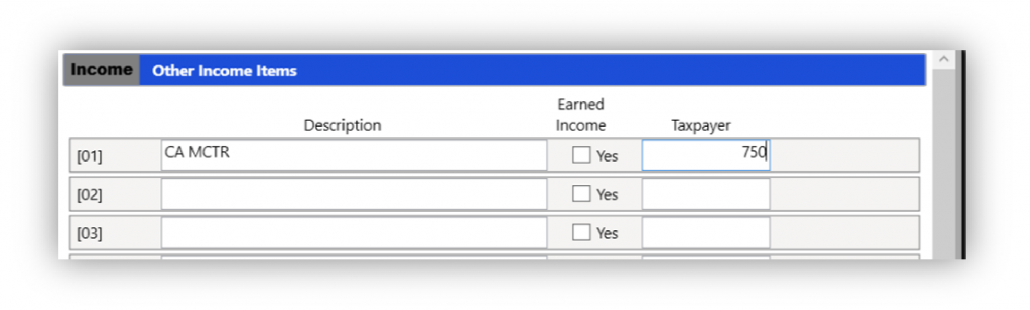

In our system you can handle and enter this in a variety of ways depending on your decisions. First if you want to claim this as federal income you can enter that directly as “Other Income” on Federal Schedule 1 line 8z. This is not “Earned Income” so be careful not to check that box. You can also use our 1099-Misc input schedule but nothing was withheld so there isn’t anything to link to a state electronic filing state record.

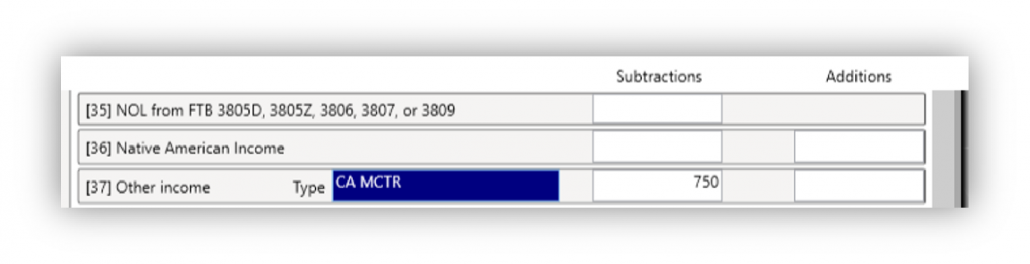

Then to back it out on the CA state side you will go to Schedule CA Adjustments and enter as an “Other Income” subtraction on line 37.

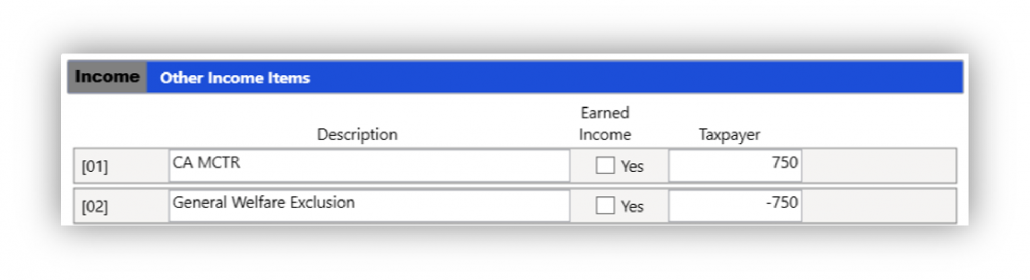

If you decide that it is not taxable, we would recommend making offsetting entries in the “Other Income” section. One positive entry to account for the reporting of the 1099-MISC the IRS would have received, and one negative entry to offset it. You will not need to make an adjustment on CA Schedule CA.

I wish you luck in your continued research and hope this article helped you in one way or another. I have no doubt that we will have more information coming hopefully soon.

Scott Dalton, E.A.