Qualified Clean Vehicle Credit

There has been some confusion regarding this credit and specifically Tesla, Inc. As of now the information that the IRS has published regarding tax year 2022 purchases is that these have been phased out of the credit. This manufacturer has sold more than 200,000 vehicles and as of 2020 the credit available is zero. We believe the confusion comes in that the IRS links from within the same publication information for purchases that take place in 2023 or later.

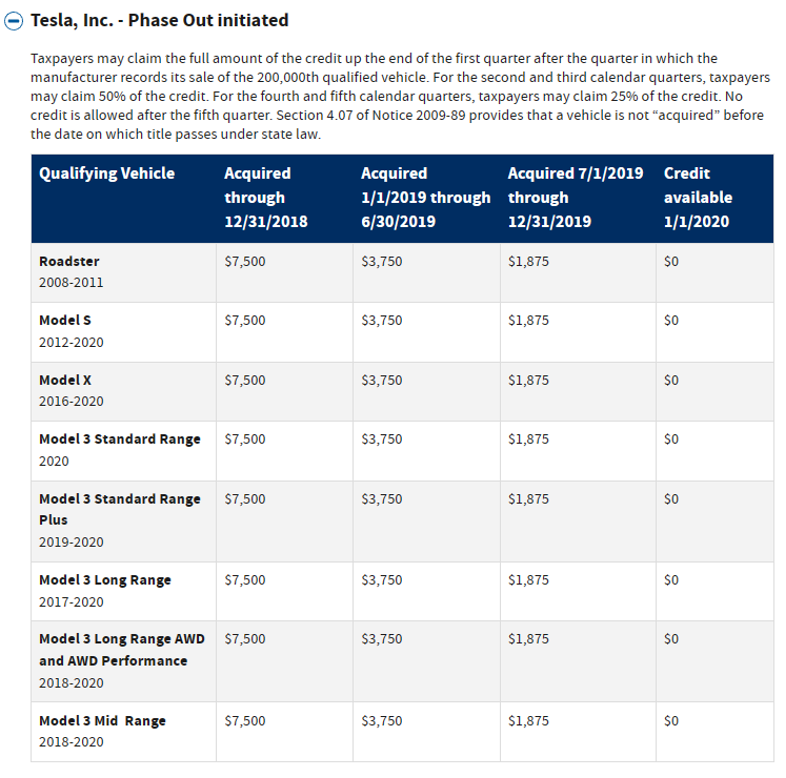

“Taxpayers may claim the full amount of the credit up the end of the first quarter after the quarter in which the manufacturer records its sale of the 200,000th qualified vehicle. For the second and third calendar quarters, taxpayers may claim 50% of the credit. For the fourth and fifth calendar quarters, taxpayers may claim 25% of the credit. No credit is allowed after the fifth quarter. Section 4.07 of Notice 2009-89 provides that a vehicle is not “acquired” before the date on which title passes under state law.”

The IRS may change these phaseouts in the future and we have heard there has been ongoing discussion. The current IRS published materials that our programs abide by, have those credit amounts currently set to zero. If changes are made, and that information is published, we will make the applicable changes.

– Your Taxware Team