Remotely Signing the 8879

The IRS requires that an 8879 be signed by the taxpayer before the 1040 can be efiled. Usually this would be a physical signature in person, but there are ways to do this without the taxpayer stepping foot into your office.

A great solution for remotely signing an 8879 is the Adobe Acrobat program. This is a free software that is most likely already on your clients’ computers and it now has the option to fill and sign documents electronically.

Here are the steps:

1. Save the 8879 as a pdf and email it to your client (we recommend password-protecting all sensitive data)

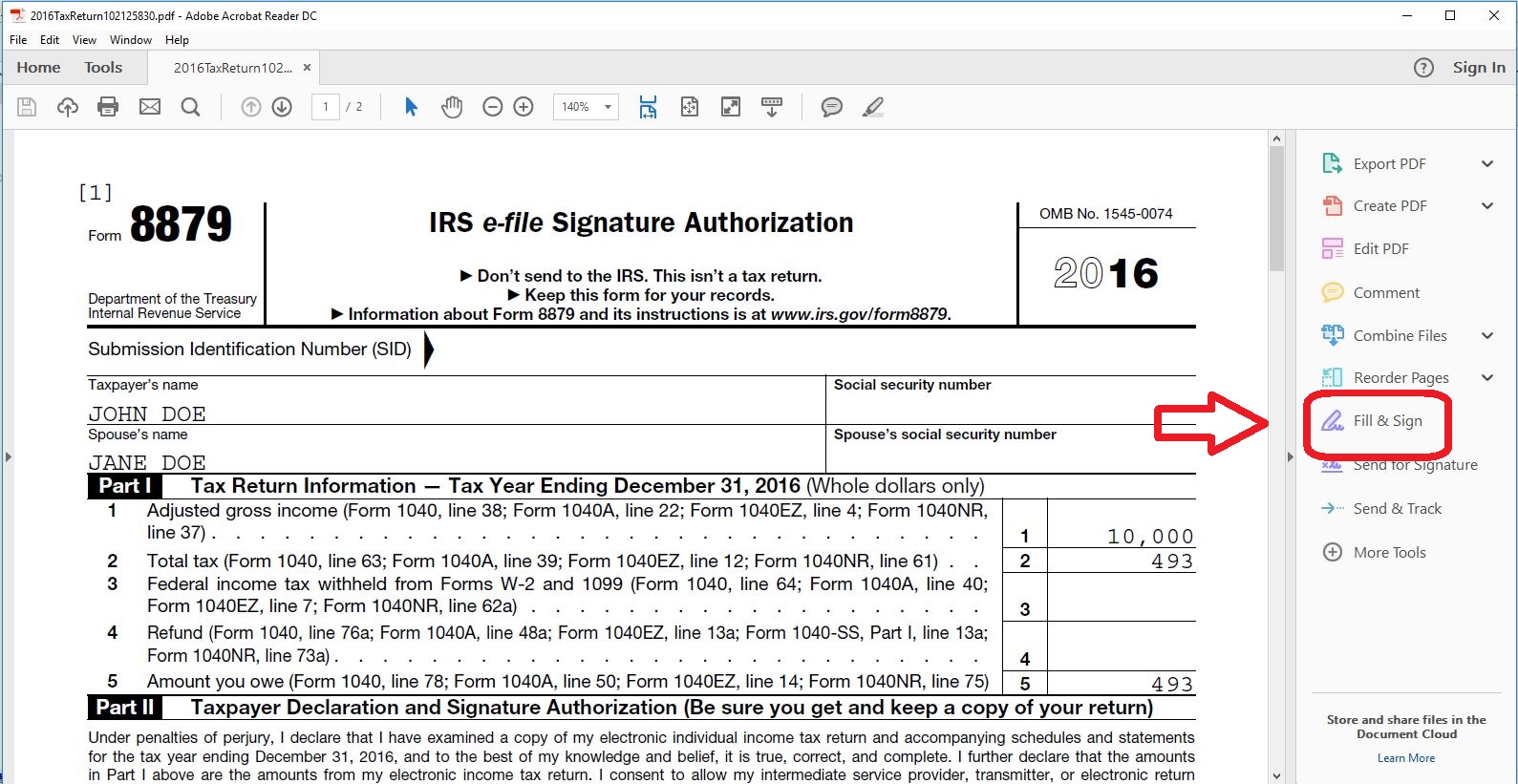

2. Once your client receives the pdf, they will save it to their computer and open it in Adobe Acrobat or Reader. This is likely already their default.

3. Click Fill & Sign

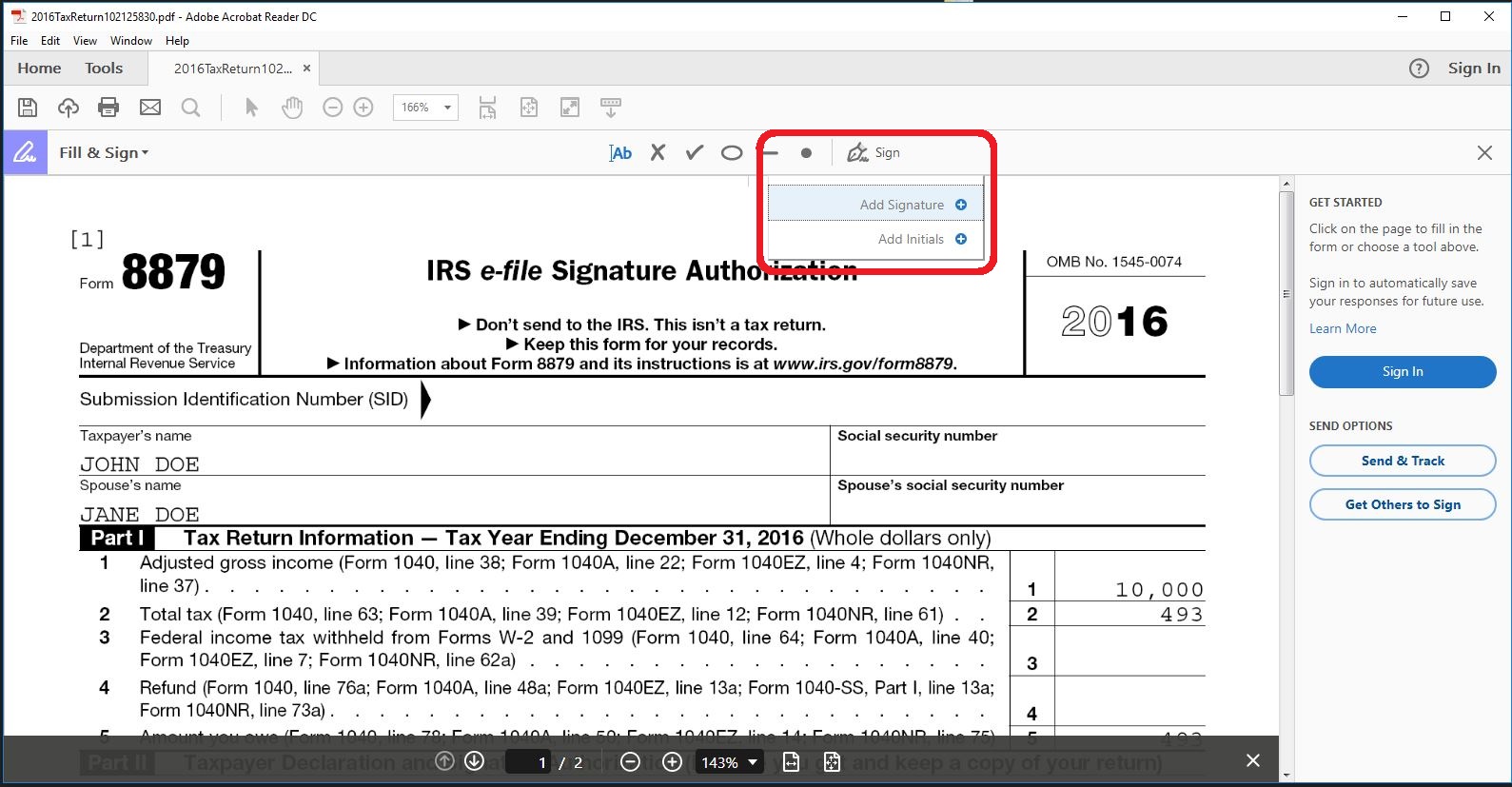

4. Click Sign

5. Click Add Signature in the drop-down

6. Your client can either type their name, draw their name with the mouse, or upload an image of their signature.

7. Drag the signature to the appropriate line

8. Your client can now save the file and email it back to you for your records.