The Tax Cuts and Jobs Act of 2017

By King T. Dalton, CPA and Founder of Taxware Systems, Inc.

This is a preliminary analysis of the new tax act that will affect 2018 tax returns, and is based on my understanding of the new law, which may need further clarification. The analysis is not intended to be complete, but to provide a guide to the significant changes. Taxware is working to update our Individual Tax Planning programming to incorporate the new law as much as possible.

- The standard deduction has been doubled from $6,350 to $12,000 for single individuals and to $24,000 for married couples. The addition for those over 65 is the same as 2017. The increase will rule out a need to itemize deductions for those who have less than these amounts as itemized deductions.

- There is no longer a deduction for personal exemptions.

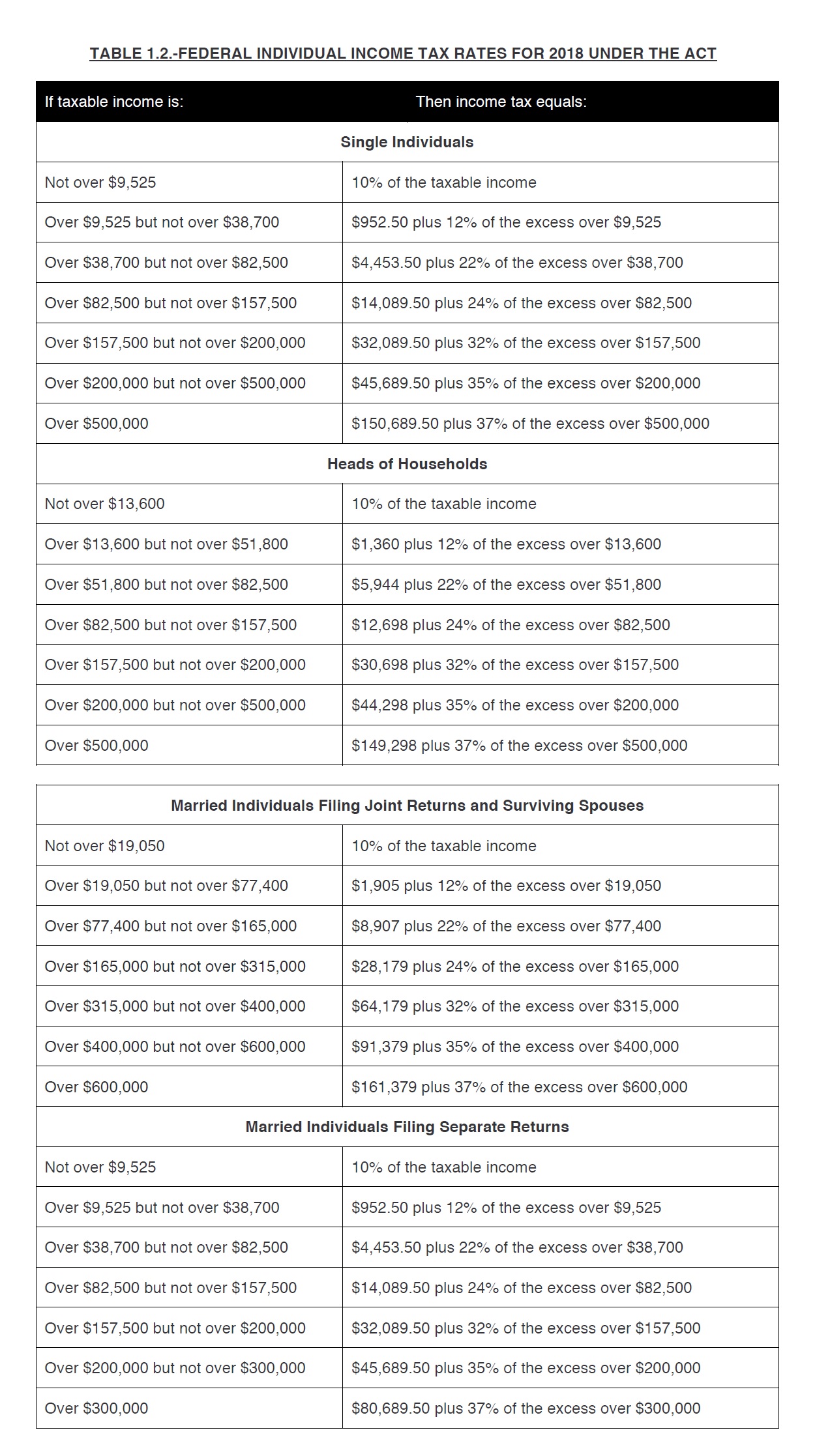

- The rates on taxable income have been reduced and the brackets changed. See the attached tax rate schedule.

- Returns for dependent children(Kidde Tax) has been simplified. It is no longer necessary to prepare these returns in conjunction with parents and siblings for unearned income. Each dependent child will now be taxed on their portion of the unearned income using estate and trust tax rates.

- The child tax credit has been increased to $2,000 per qualifying child. The definition of a qualifying child is the same as before. There is also a temporary provision to provide a $500 nonrefundable credit for qualifying dependents other than children. The maximum refundable credit may not exceed $1,400 per qualifying child. To qualify for the credits (both refundable and non-refundable a taxpayer must include a SS# for each qualifying child and the SS# must be issued before the due date for filing of the return. This requirement does not apply to a nonchild dependent for whom the $500 non-refundable credit is claimed. A qualifying child is an individual who has NOT attained the age of 17 during the taxable year. The credits phase out for taxpayers with AGI in excess of $400,000 (married filing jointly) and $200,000 for all others.

- Education savings accounts modifies section 529 plans to allow such plans to distribute not more than $10,000 in expenses for tuition incurred during the taxable year with the enrollment or attendance of the designated beneficiary at a public, private or religious elementary or secondary school.

- The overall limitation of itemized deductions for high income taxpayers is suspended.

- Home mortgage interest deduction is limited to that paid on acquisition indebtedness of $750,000 (married filing jointly) and $375,000 for married filing separately. Acquisition indebtedness incurred before December 15, 2017 is $1,000,000 (married) and $500,000 (separate).

- Itemized deductions for property and state income taxes are limited to $10,000 ($5,000 married filing separately.

- Personal casualty losses may only be claimed if the casualty was attributable to a disaster declared by the President.

- Charitable contributions may be deducted up to 60% of AGI instead of the previous 50%.

- Miscellaneous deductions subject to the 2% floor are suspended.

- Medical expense deductions must exceed 7.5% for all taxpayers (same as 2017).

- Alimony and separate maintenance agreement payments are no longer deductible by the payor nor are they taxable to the recipient. The effective date is for any divorce or separation instruments executed on or before December 31, 2018.

- Moving expenses are no longer deductible with the exception of Armed Forces. Reimbursements for moving expenses will now be taxable, again with the exception of Armed Forces.

- The special rule that allows a contribution to one type of IRA to be recharacterized as a contribution to the other type of IRA does not apply to a conversion contribution to a Roth IRA.

- The period during which a qualified plan loan offset amount may be contributed to an eligible retirement plan as a rollover contribution is extended from 60 days after the date of the offset to the due date (including extensions) for filing the Federal income tax return for the taxable year in which the plan loan offset occurs.

- The estate and gift tax exemption has been increased from $5 million to $10 million for persons dying and gifts made after December 31, 2017.

- The AMT exemption amount and exemption amount thresholds has been increased to $109,400 (married) half of this amount for married filing separately and $70,300 for all other taxpayers other than estates and trusts. The phaseout thresholds are increased to $1,000,000 for married and $500,000 for all others except estates and trusts.

- The individual responsibility payment enacted as part of the Affordable Care Act will be zero with respect to health coverage status for months beginning after December 31, 2018.

- For years beginning after December 31, 2017 and before January 1, 2026 an individual taxpayer may deduct 20 percent of qualified business income from a partnership, S corporation or sole proprietorship as well as 20 percent of aggregate qualified REIT dividends, qualified cooperative dividends, and qualified publicly traded partnership income. This is a deduction from taxable income, not AGI. A limitation based on W-2 wages paid is phased in above a threshold amount of taxable income. A disallowance of the deduction with respect to specified service trades or businesses (accountants, lawyers, doctors, etc.) is also phased in above the threshold amount of taxable income.

Qualified business income means the net amount of qualified items of income, gain, deduction, and loss with respect to the qualified trade or business of the taxpayer from sources within the United States. It does not include W-2 income from an S-corporation or Guaranteed payments from a partnership. A qualified trade or business means any trade or business other than a specified service trade or business and other than the trade or business of being an employee.

A Specified Service Trade or Business includes health, law, accounting, actuarial science, consulting, performing arts, athletics, financial services and brokerage services. Engineering and architecture services are excluded as Specified Services. There are threshold amounts of $315,000 (married joint) and $157,500 (others). Income over the threshold amounts plus $100,000 (married joint) or $50,000 (others). Income less than the thresholds are excluded from the definition as a Specified Service Trade or Business.

In computing the qualified business income with respect to a Specified Service Trade or Business, the taxpayer will take into account only the applicable percentage of qualified items of income, gain, deduction or loss, and of allocable W-2 wages. The applicable percentage with respect to any taxable year is 100% reduced by the percentage equal to the ratio of the excess taxable income of the taxpayer over the threshold amount bears to $100,000 (married joint) or $50,000 (single, MFS).

In general, for each qualified trade or business, the taxpayer is allowed a deductible amount equal to the lesser of 20 percent of qualified business income with respect to such trade or business or 50 percent of the W-2 wages with respect to such trade or business. However, if the taxpayer’s taxable income is below the threshold amount, the deductible amount is equal to 20 percent of the qualified business income with respect to each respective trade or business.

If the taxpayer’s taxable income is above the threshold amount, the limitation is the greater of 50 percent of the W-2 wages paid or the sum of 25 percent of the W-2 wages plus 2.5 percent of the unadjusted basis, immediately after acquisition of all qualified property. Taxware is working to update our individual tax planning programming to incorporate the new law as information is made available.

WILL TAXWARE HAVE A PROGRAM FOR ESTIMATING THE 2018 TAXES

Yes, there is currently a Tax Planning feature in both the Legacy and Next Generation versions of the 1040 program.

In Next Generation, it is located on line [29] of the Summary Menu and in the Legacy program it is on line [11] of the main menu.